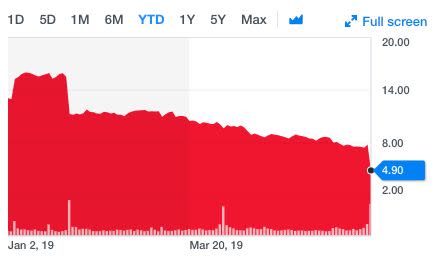

GameStop's stock in free fall 'as business burns to the ground'

Is it game over for GameStop?

Shares of the world’s largest video game retailer tanked more than 37% Wednesday after another dismal quarterly earnings report.

The Grapevine, Texas-based retailer reported a 13.3% drop in first-quarter revenue and a 10.3% slide in sales as consumers buy more downloadable games instead of physical versions from stores. It also expects full-year 2019 sales to fall between 5% and 10%.

New hardware sales sank 35% in the quarter as gamers wait for new consoles to hit the market from Sony and Microsoft.

The lack of new title launches in the first quarter led to a 4.3% drop in new software game sales, while sales of pre-owned games tumbled 20.3%.

The only bright spots were accessory sales, up 0.6% and collectibles, which rose 10.5%.

Investors were surprised to hear that GameStop is scrapping its quarterly dividend immediately, a sign the company has no money to spare. The move is expected to save the retailer $157 million a year.

GameStop’s death knell

Reaction from Wall Street analysts was swift and painful.

Benchmark analyst Mike Hickey cut his price target on the stock from $9 to $5 “as business burns to the ground,” he wrote in a note to clients. He rates GameStop a “sell.”

It appears Wall Street is already losing patience with GameStop’s new management. CEO George Sherman joined the company in April and promised to take a “thorough” review of the business and execute both “deliberately and with urgency.”

But after the company’s latest earnings call, analysts were left wanting more.

"The latest GME management team iteration was uninspiring and lacked any coherent articulation of a tangible vision on how to transform the business, in our view," Hickey wrote. "Despite a valuation that's been 'nuked' and the $157M in annual savings from the terminated divided, GME lacked the courage to repurchase shares as management appears focused near term on learning the business.”

Credit Suisse analyst Seth Sigman cut his stock price target to $6.50 from $7 and rates the stock an “outperform.”

"The new management laid out some initial plans to improve results, that on paper make sense, but the timeline, and potential reinvestment required, remain unknowns, at a time when the company is also battling external factors [including] a waning cycle, increasing digital penetration, and continued weakness in pre-owned," Sigman wrote to clients.

Changing gaming habits

GameStop, which operates more than 5,800 stores in 14 countries, has come under pressure in recent years as consumers shift from buying physical video games to downloading or streaming them.

GameStop also has some big competition waiting in the wings. Apple’s Arcade gaming service is set to launch this fall, while Alphabet is expected to announce June 6 a release date for its cloud gaming service, Stadia.

Alexis Christoforous is co-anchor of Yahoo Finance’s “The First Trade.” Follow her on Twitter @AlexisTVNews.

Read more:

Head of manufacturers group calls Mexico tariffs 'a Molotov cocktail'

Tesla's financing decision means Musk is being more ‘grown-up’

Gas prices have probably peaked, expert says

FAANG stocks are not dead – they're 'taking a pause'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.