FOMC Preview: Threading the needle on rate changes for July

Will the escalation of trade war tensions, combined with a flurry of disappointing economic data, push Federal Reserve Chairman Jerome Powell to signal future rate cuts in next week’s policysetting meeting?

While most of Wall Street is not expecting rate changes in the Federal Open Market Committee meeting concluding June 19, analysts are all over the place on predictions for Powell’s message on the future path of policy.

The challenge: Powell may reiterate the Fed’s commitment to steadying the economy amid heightened uncertainty while avoiding any outright promises to lower rates.

“Chair Powell will have to thread the needle in sounding sanguine on the outlook, but also discuss that the Fed is ready to ease in order to make sure the recovery continues,” Bank of America analysts wrote June 14.

A number of analysts think the Fed will use the June meeting to tee up a rate cut in the July meeting, viewing recent developments as bolstering the case for an “insurance” cut that could preempt a slowdown.

Expectations are high, as markets are pricing in a high probability of rate cuts in July. As of Friday afternoon, Fed funds futures contracts reflected an 85.5% chance of at least one rate cut by the end of the July 31 meeting. Markets are nearly swearing by a rate cut by the end of this year, with contracts showing a 99% chance of at least one cut by the end of the December 11 meeting.

Dodging the dot plots

Although the Fed spent the first half of this year remaining “patient” to see if risks were on the upside or downside, trade spats with Mexico and China, a lackluster jobs report, and soft inflation data are pointing increasingly to the need for Fed action.

But Wall Street expects the FOMC to be careful with its dot plots, which have historically been a way for policymakers to telegraph future rate policy to market participants.

But amid uncertainty, policymakers will be hesitant to make any explicit promise for future rate hikes or rate cuts, choosing instead to harp on its principle of data-dependence.

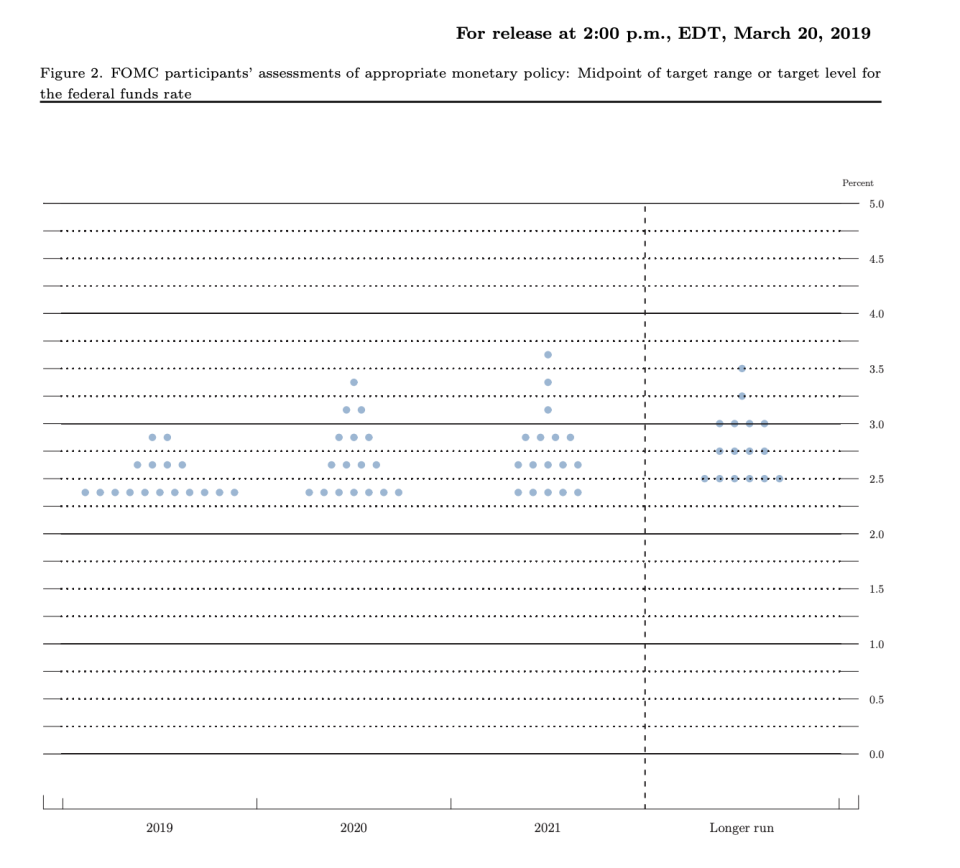

The Fed’s most recent dot plots (from March) showed the median member of the committee seeing a case for no rate changes in 2019 and one rate hike in 2020.

TD Securities, Credit Suisse, and Morgan Stanley are among the research teams predicting that the median dot will continue to signal no rate cuts nor rate hikes for 2019. And all three shops said they expect the median dot to come down for 2020, to also signal no rate cuts or rate hikes.

“The Fed does not pre-plan easing cycles,” Morgan Stanley wrote.

Signaling somewhere between no and 3 rate cuts

But Wall Street diverges in whether or not the Fed will ultimately face economic developments that ultimately push them to ease monetary policy.

Barclays was among the research teams predicting a strongly dovish reaction, expecting a 50 basis point cut in July followed by a 25 basis point reduction in September.

“In our view, the monetary policy stance is likely too restrictive given increased headwinds since the committee halted its cycle in December,” Barclays wrote June 13.

On the other side, UBS wrote June 12 that they could see the Fed extending its stance of patience, preferring more data before they can conclude that the economy needs looser policy. Acknowledging that their prediction is out of consensus, UBS wrote that the biggest risk — tariffs — could dissipate at any moment.

“If we are wrong, and the economy is weaker, or escalation of the trade war causes a faster slowing in the economy, the Fed will still take a few months of data before they conclude the economy has slowed more than they desire,” UBS wrote.

Powell’s press conference, in addition to the dot plot release, could add credibility to one of these predictions. But with markets pricing in such a high chance of a 100 basis point cut by December — more dovish than even the Wall Street firms — there is also a high chance of the markets going sour over a less-dovish-than-expected Fed meeting on June 19.

“It will be difficult for the Fed to ‘out dove’ market expectations risking a modest sell off at the front end,” Bank of America wrote June 14, adding that they could see the U.S. dollar strengthening as a result.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Lael Brainard: Regulators may be 'whittling away' at financial stability

Lael Brainard: There's 'no destination point' for full employment

Lael Brainard: Fed 'prepared to adjust policy' as trade concerns mount

Questions loom over Fed efforts to make sure the 'roof isn't leaking'

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance onTwitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.