Fed Preview: Expect no change to rates, but forward guidance could prove critical

On Wednesday, the Federal Reserve will hold its second policy-setting meeting of the year. As the Fed continues to message a need for “patience” on monetary policy, Wall Street analysts are expecting no changes to rates but will be listening very closely for detail on the path of future rate moves and the timing of its balance sheet rolloff process.

In its January meeting, the Federal Open Market Committee took on a more dovish stance by signaling a pause on rate hikes for the time being. Fed Chair Jerome Powell said “patience” was needed while the Fed assesses “muted” inflationary pressures and geopolitical concerns abroad, noting on multiple occasions that the central bank needs to be “data dependent” as it makes future decisions.

Since that meeting, the data has come in mixed. An impressive jobs report for January was offset by a disappointing month of only 20,000 added non-farm payrolls in February. Retail sales numbers took a dip and manufacturing readings have been slower than expected. But the ISM services index has shown strength and the fourth-quarter GDP reading — at an annualized rate of 2.6% — reflected a solid finish to 2018.

Wall Street doesn’t expect the noisy data to convince the Fed otherwise on its “patient” stance, but hints on future policy could come from Powell’s conference in addition to the Fed’s summary of economic projections.

As of 2:39 p.m. ET on March 15, fed funds futures were pricing in a 98.7% chance of rates being held steady with only a 1.3% chance of a rate cut.

Rates

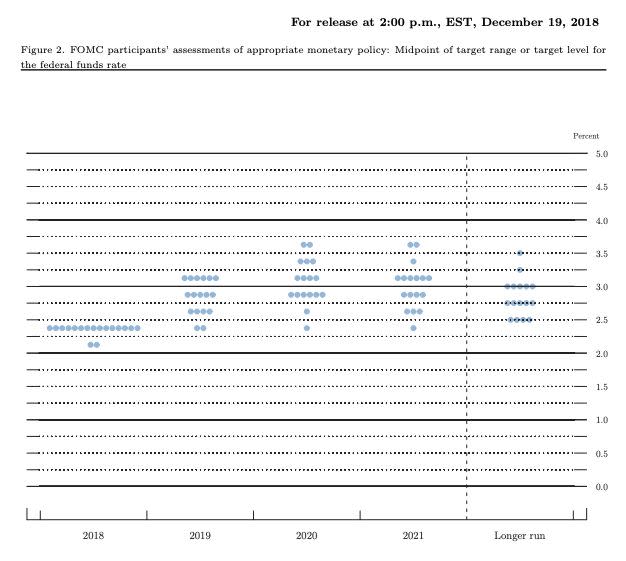

The summary of economic projections will include the first set of “dot plots” we’ve seen in 2019, which map policymakers’ predictions for future levels of the federal funds rate. In line with the Fed’s decision to pause on rate hikes for the time being, the dot plots are expected to show lower expectations for future rate hikes.

Fed officials appear to have signaled no rate hikes on the table for the first half of the year, but there’s some disagreement over exactly how many rate hikes we might see by the end of 2019.

St. Louis Fed President James Bullard, who is a voting member of this year’s FOMC, told CNBC at the end of February that he sees the normalization of interest rates as “coming to an end.”

Wall Street is also split on projections for rate hikes this year.

JPMorgan Research’s Michael Feroli noted March 14 that the dot plots will likely indicate an expectation for zero hikes this year.

“The big picture is that we don’t expect the economic forecast to have changed too much. Yet we do believe the interest rate projection will move down a substantial amount,” Feroli wrote.

Capital Economics’ Andrew Hunter agrees, writing on March 13 that the “weaker data rule out additional rate hikes.”

But UBS wrote March 11 that they do not expect Powell to “capitulate” to expectations for zero rate hikes and estimated that the median dot in the dot plot will likely signal one hike.

Balance Sheet

A number of Wall Street analysts expect the Fed to telegraph its plans on ending its balance sheet normalization process in this coming FOMC meeting.

Barclays wrote March 14 that they believe this will be a bigger deal than its messaging on interest rates.

“We believe that the focus of the March FOMC meeting will be on the Fed’s balance sheet plans. We expect the committee to announce that it will end the securities runoff in June and begin to reinvest maturing principal from Treasuries and MBS back into Treasuries beginning in July.”

In 2017, the Fed kicked off its balance sheet normalization program, aimed at undoing the Fed’s massive holdings of agency mortgage-backed securities and long-term Treasurys that it amassed after the financial crisis. Powell spooked markets in December by saying that he doesn’t see the Fed “changing” the pace of asset rolloffs, which some worried was harming market liquidity.

Market participants have been wondering when the Fed would stop shrinking its balance sheet, and recent clues have given markets reason to believe it will end sooner than later.

Barclays’ prediction that the rolloff will end this summer is earlier than other estimates. Morgan Stanley wrote March 13 it expects the balance sheet normalization process to end in September while Capital Economics estimates the end to be in October.

Data dependency

All in all, the Fed is expected to make no policy action, but its forward guidance could prove critical for the outlook for the rest of 2019.

In testimony on Capitol Hill two weeks ago, Powell alluded to the challenge that the Fed faces.

“While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals,” Powell told Congress.

How Powell reassesses those crosscurrents in Wednesday’s meeting will be telling to the Fed’s future decision-making on rate hikes and on the balance sheet.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

El-Erian: The Fed faces an 'inherent contradiction'

Former TARP watchdog: 'No question' that banks will need another bailout

Fed Chair Powell says ‘No,’ President Trump cannot fire him

The bull market is almost 10 – here are some facts and figures

Congress may have accidentally freed nearly all banks from the Volcker Rule