Fed Chair Powell, Vice Chair Clarida speak - What to know in markets Thursday

Two important speeches are scheduled for Thursday from Federal Reserve Chairman Jerome Powell and Vice Chairman Rich Clarida. Powell is set to speak at the Economic Club of Washington, D.C., at 12:45 p.m. ET, where he will be delivering prepared remarks before taking questions.

Following Powell’s speech, Clarida will be speaking at 7 p.m. ET at the Money Marketeers of New York University on economic outlook and monetary policy.

Both speeches will be closely watched on the back of the Federal Open Market Committee’s (FOMC) meeting minutes released on Wednesday. The minutes from the December meeting showed that a few members weren’t keen on hiking rates. Furthermore, the minutes revealed that, “Many participants expressed the view that, especially in an environment of muted inflation pressures, the Committee could afford to be patient about further policy firming.”

Mark Hamrick, Bankrate.com's senior economic analyst, said that the December meeting minutes shed more light on the Fed’s decision-making process than usual. “Newly-released minutes from the December Federal Open Market Committee indicate that there was more going on behind the scenes than indicated by the official statement and Chairman Jerome Powell’s December news conference,” he told Yahoo Finance.

Powell’s and Clarida’s language will be critical as they gear up to speak on Thursday, especially after Powell used the word “patient” last week to describe the central bank’s monetary policy approach going forward.

Economic data will be light on Thursday. Investors can expect initial jobless claims for the week ending January 5, which economists are expecting to see a decline from 231,000 the week prior to 225,000. Wholesale inventories for November are expected to have risen 0.5% from October.

There are no major corporate earnings reports scheduled for Thursday.

And here’s what caught markets correspondent Myles Udland’s eye.

Market commentary

2018 was the stock market’s worst year since the financial crisis.

Investors blamed the decline on worries over slower earnings growth, the trade war, Fed policy, the U.S. economy, the health of U.S. corporations, the global economy, the U.S. housing market, among other factors pressuring markets.

In a note to clients published Wednesday, Bank of America Merrill Lynch economists confirmed this idea, writing that there was “no single major cause for financial tightening.”

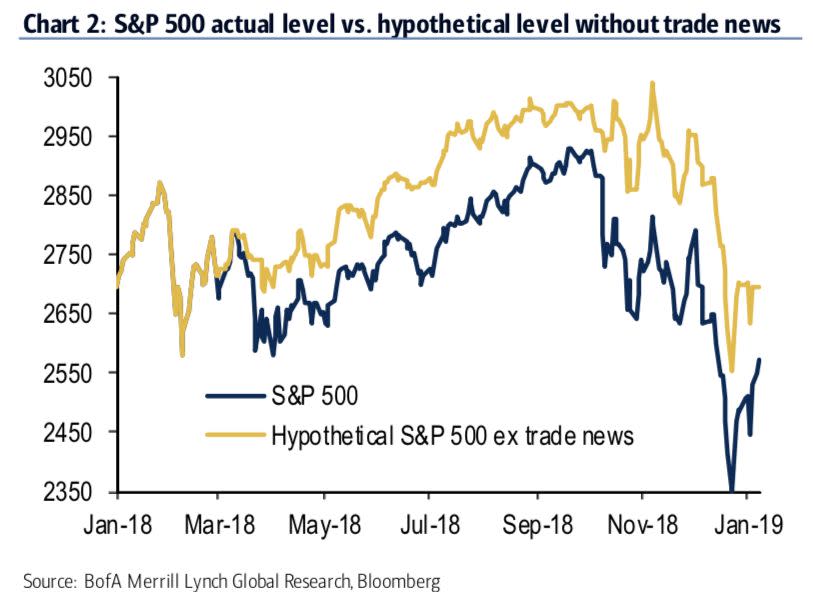

BAML’s work showed that the biggest factor contributing to the market’s decline, however, was clearly trade.

“Until recently, trade was the biggest drag on the equity market during the correction,” the firm writes. “Trade protectionism has been the most important headwind to US equities since the start of last year, taking 4.4% off the S&P 500. In fact, our analysis suggests the index would not have finished last year in the red had it not been for fears of a trade war.”

So for any investors out there that underperformed in 2018, this chart from Bank of America offers a new metric that might bail you out — trade-adjusted performance.

BAML adds that their work “probably understate the negative impact of the trade war because they only account only for its direct effect on equities.”

Warnings about the global economy — most notably China — from Apple (AAPL) and Samsung in recent days back up the idea that overall market performance belies the actual stresses trade fights are having on the global economy. This also explains why we continue to see the market quick to embrace any positive news about trade. And why Trump keeps tweeting about how well trade talks with China are going.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Roku CEO responds to short-seller's tweet about Apple and Samsung

CPI, Powell, Clarida — What to know in the week ahead

Why 2019 could be a stellar year for gold

Facebook and PayPal are a match made in heaven, according to MoffettNathanson