Facebook stock price plunge: Why the social network's value is in free fall

Facebook's share price is plunging, setting the company up for the worst day in stock market history.

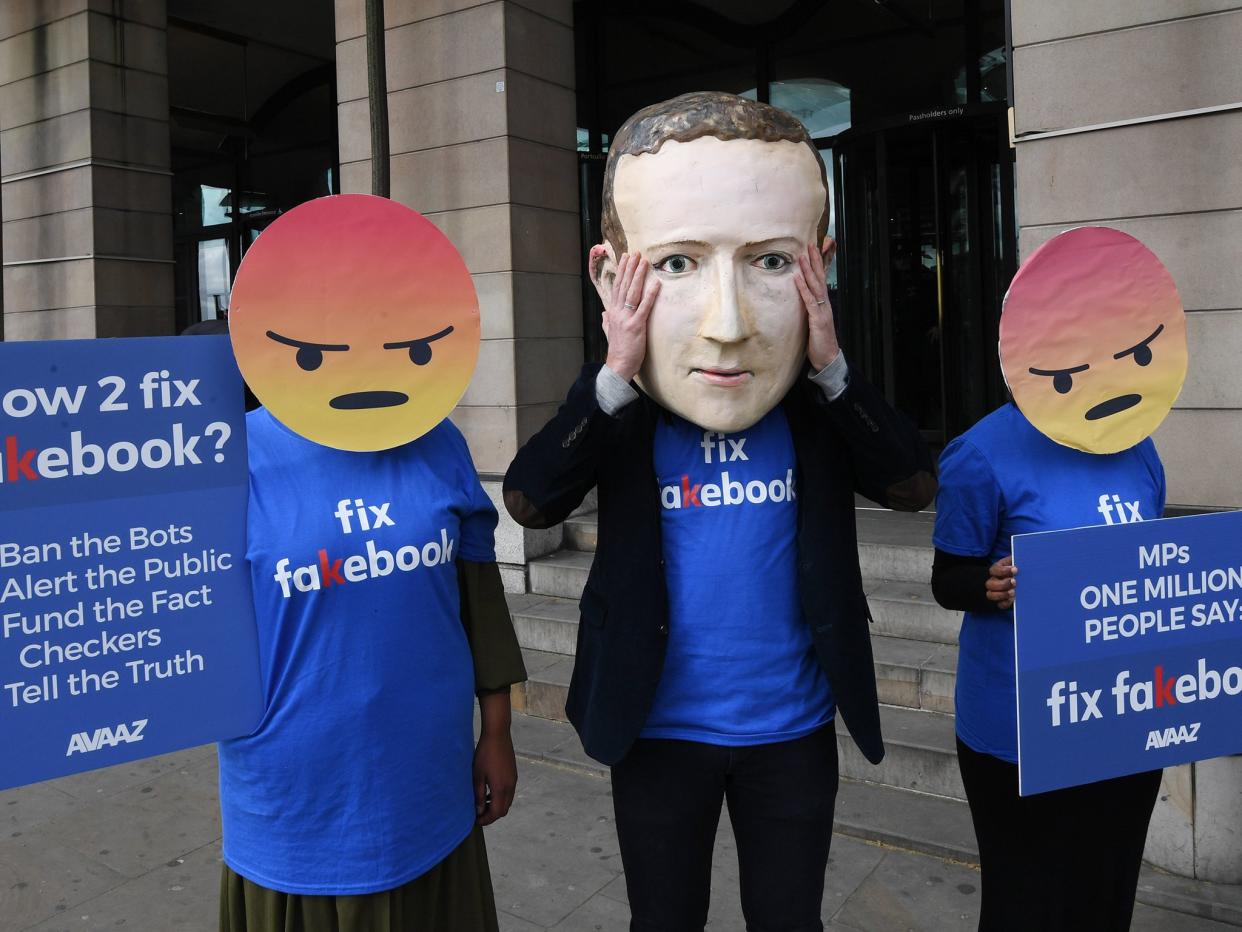

The company has lost more than $100 billion in value, and its share price has dropped nearly 20 per cent. That has meant that Mark Zuckerberg alone has seen a fifth of his net worth destroyed by the market.

The reasons for such a dramatic day of trading are complex – but, according to some analysts, have been a long time coming.

The drops appear to be the result of vast amounts of criticism and concern all around the world. From Europe's new data regulations to the cost of trying to deal with worries about Facebook's security, the company long held as a vast Wall Street success story appears to be running into problems.

Facebook's share price plunge came immediately after the company had announced its latest results. As soon as they were revealed, investors rushed to sell shares in the company.

The results were not simply bad this time around – they came with a warning that Facebook might be hit by problems in the coming years, too, because of the costs of improving privacy safeguards and slowing usage in its biggest advertising markets.

There are a wide variety of possible reasons for those problems, many of which could impact the company for years to come. Here is a selection of some of those issues.

Advertising slowing down

Facebook likes to sell itself as a technology company: it often talks about connecting people, and most of its public statements are about new features and innovation. But it is really an advertising company, at least in terms of its profits.

Those profits are now slowing down, the company said. That is in part because of technology like ad blockers, which allow people to ban those ads, the company said.

GDPR

Facebook claimed that the new European data protection regulations known as GDPR only accounted for a limit part of its downturn. But they were also only in effect for a small part of the time being reported.

Data protection regulations of this kind could have significant problems for companies like Facebook. But in the long term they might work out well for Facebook, at least against its smaller rivals, because the massive company has more resources to deal with the complexities and difficulties of the privacy law.

Security and privacy concerns

Facebook also makes its money by showing a wide variety of content, and collecting data about the people who are watching it. But both of those activities have come under threat in recent months, amid new concerns about how secure and private the site really is.

Mark Zuckerberg said during the company's earnings call that the company's attempts to address those problems will hurt its profits.

They include a wide variety of changes, including recruiting far more content moderators who will check over posts on the site and ensure that they are not problematic for those that see them.

"As I've said on past calls, we're investing so much in security that it will significantly impact our profitability," CEO Mark Zuckerberg said in an earnings call.

"We're starting to see that this quarter."

Users leaving – or at least not joining

This has long been the fear for Facebook: it requires new users to grow, and it might simply have run out of people to recruit. What's more, there is an increasing concern that young people are leaving as older ones join.

"Teens are abandoning - or just not joining the site - as 'oldies' migrate there," said Richard Holway, chairman at UK tech analyst house TechMarketView.

The company hopes to offset some of this with its move to other platforms, such as Instagram. But popular as those are Facebook itself still remains the company's biggest product by far, and growth overall now appears to be slipping.