How to Extract Profits From Wheaton Precious Metals Stock

Do you want to have your cake and eat it too? Or better yet, how about enjoying leadership and relative strength at the start of a new bull market? Then look no further than Wheaton Precious Metals (NYSE:WPM) stock to mint some big-time profits.

Source: Shutterstock

Has the market run its course? It’s a popular question these days given the U.S. averages’ stellar first-quarter run. But rather than simply run away in fear or run toward equities with open arms due to fear of missing out, purchasing streaming metals outfit Wheaton Precious Metals stock looks like a great hedged bet.

Formerly known as Silver Wheaton Mining, WPM is in the business of purchasing metals via negotiated fixed-price contracts called streaming. And it’s a good business to be in and for other investors taking stock in shares of Wheaton Precious Metals as well.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The low-cost deals in exchange for upfront capital, which Wheaton Precious Metals secures are with other producers such as Vale S.A. (NYSE:VALE), Goldcorp (NYSE:GG), Pan American Silver (NASDAQ:PAAS) and Barrick Gold (NYSE:ABX).

The business doesn’t make WPM the proverbial house like Vegas, but these high margin contracts do allow WPM stock to offer investors stronger cost predictability, direct leverage to increasing precious metals prices and a high-quality asset base.

Now with silver, gold and other metals finding price floors and WPM smartly diversifying and growing its portfolio away from silver in this overall stronger operating environment, conditions on the WPM stock chart also look good for investors interested in going long. Wheaton Precious Metals also has less risk and greater upside potential at current levels.

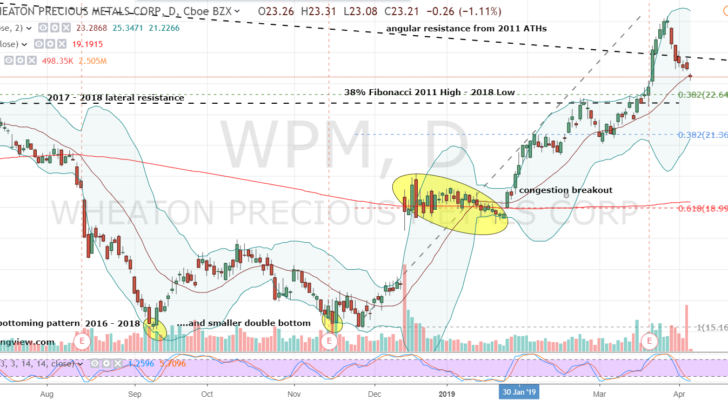

WPM Stock Daily Chart

Within the metals complex, WPM stock has proven itself a technical leader in 2019. Shares have displayed relative strength compared to its peer group with a year-to-date gain of around 19%. But that’s not all Wheaton Precious Metals stock has going for it.

In 2019 and on the heels of confirming a combination double-bottom with an explosive mid-December bullish gap, WPM has minted an uptrend. The bullish foundation looks even more durable as the series of higher highs and lows began with a solid-looking breakout in January.

The breakout sent shares firmly into bull territory after toiling in a congestion pattern with the longer-term, 200-day simple moving average for a handful of weeks. And Wheaton Precious Metals stock has never looked back.

Now, with shares pulling back over the course of several sessions, it’s time to consider buying WPM shares on weakness as technical support for the uptrend is tested. How would I approach a purchase of Wheaton Precious Metals stock in today’s market? With Wheaton Precious Metal stock’s stochastics oversold, but not yet showing a crossover signal, having a bit of constraint to avoid potentially catching a knife makes sense.

Specifically and to help avoid any larger corrections, my suggestion is to simply wait for confirmation of a pivot low on the daily chart before buying WPM.

If a buy trigger does occur but shares fail to follow-through on the upside, keeping a stop tethered to the trend’s newly formed show of support makes a good deal of technical sense. This exit also offers investors stronger “cost predictability” in Wheaton Precious Metals stock and that makes it worth betting on here.

Disclosure: Investment accounts under Christopher Tyler’s management do not currently own positions in any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional options-based strategies, related musings or to ask a question, you can find and follow Chris on Twitter @Options_CAT and StockTwits.

More From InvestorPlace

The post How to Extract Profits From Wheaton Precious Metals Stock appeared first on InvestorPlace.