EUR/USD Mid-Session Technical Analysis for January 10, 2019

The Euro is trading lower on Thursday after surging to its highest level since October 17 earlier in the session. The main catalyst behind the Euro’s recent strength is the weaker U.S. Dollar. The dollar is being driven lower by a suddenly dovish U.S. Federal Reserve. Yesterday’s Fed minutes reiterated what Fed Chair Jerome Powell told the markets last week that the central bank would take its time before raising rates in 2019.

At 1230 GMT, the EUR/USD is trading 1.1534, down 0.0008 or -0.07%.

Optimism over a potential trade agreement between the United States and China is also helping to underpin the Euro. Bullish traders are hoping a revival in China’s economy will spread to the Euro Zone. Gains are being capped by concerns over the strength of the Euro Zone economy and the dovish tone from the European Central Bank.

Daily Swing Chart Technical Analysis

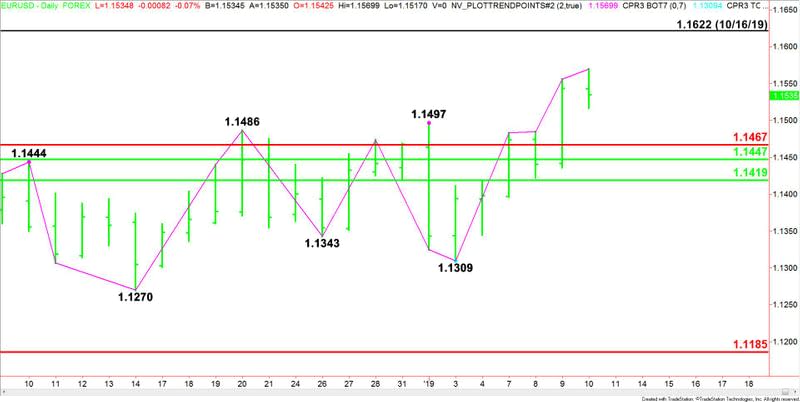

The main trend is up according to the daily swing chart. The trend turned up on Wednesday when buyers blasted through the last swing top at 1.1497. It was reaffirmed later in the session when buyers took out the next top at 1.1501. Earlier today, the Euro traded through 1.1555, further extending the rally.

The EUR/USD is up only five days from its last main bottom, however, due to the steep rally and today’s earlier price action, the Forex pair may be in a position to post a closing price reversal top. This won’t mean the trend is getting ready to change to down, but it could fuel a 2 to 3 day counter-trend pullback.

The main support is a series of retracement levels at 1.1467, 1.1447 and 1.1419.

Daily Swing Chart Technical Forecast

Based on the current price at 1.1539 and the earlier price action, the direction of the EUR/USD the rest of the session is likely to be determined by trader reaction to yesterday’s close at 1.1543.

Bullish Scenario

A sustained move over 1.1543 will indicate the presence of buyers. They are going to try to resume the earlier upside momentum. If successful, new buyers could continue to come in with an eventual goal of hitting the October 16 top at 1.1622.

The catalyst behind any spike to the upside will be further dovish remarks from Fed Chair Powell at 1745 GMT.

Bearish Scenario

A sustained move under 1.1543 will signal the presence of sellers. If this move picks up downside momentum then look for a potential retracement into the former tops at 1.1501 and 1.1497, followed by the major Fibonacci level at 1.1467.

This article was originally posted on FX Empire