E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Weakens into Close Under 50% Level at 7584.75

June E-mini NASDAQ-100 Index futures are trading lower shortly before the cash market close. The market is also posting an inside move which typically indicates investor indecision and impending volatility.

The index is likely being supported by stronger than expected U.S. consumer sentiment. However, gains are likely being limited by worries over retaliation by China for a U.S. move against Hauwei. U.S. technology companies that are being prevented with the Chinese phone company are already feeling pressure. Analysts say the Chinese government may also take action against Apple and Qualcomm.

At 18:48 GMT, June E-mini NASDAQ-100 Index futures are trading 6565.50, down 34.75 or -0.45%.

Daily Technical Analysis

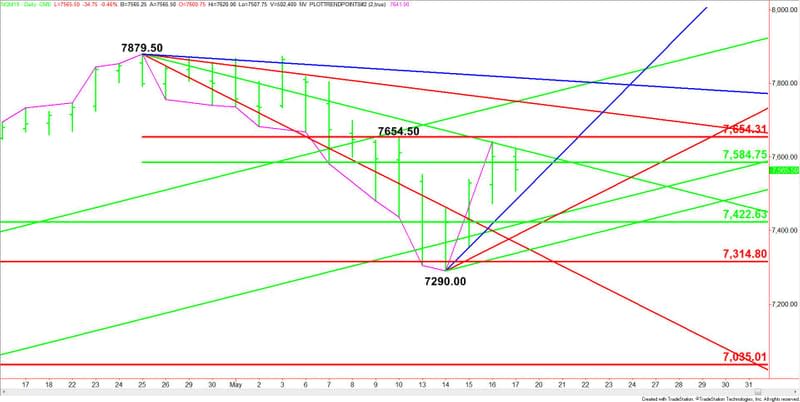

The main trend is up according to the daily swing chart, however, momentum has been trending lower since the 7879.50 main top on April 25. A trade through 7290.00 will change the main trend to down. A move through 7879.50 will signal a resumption of the uptrend.

The minor trend is down. A trade through 7654.50 will change the minor trend to up. This will also shift momentum to the upside.

The main support zone is 7422.50 to 7314.75. This zone essentially stopped the selling pressure at 7290.00 on May 14.

The short-term range is 7879.50 to 7290.00. Its retracement zone at 7584.75 to 7654.25 is the first upside target. This zone, along with a downtrending Gann angle at 7623.00 stopped the selling on Thursday and earlier today.

The short-term retracement zone is very important to the structure of the chart pattern. Aggressive sellers are going to try to form a secondary lower top on a test of this zone. If successful, they may try to drive the index back into the main retracement zone.

Daily Technical Forecast

Based on the early price action and the current price at 6565.50, the direction of the June E-mini NASDAQ-100 Index into the close is likely to be determined by trader reaction to the short-term 50% level at 7584.75.

Bullish Scenario

A sustained move over 7584.75 will indicate the presence of buyers. If successful, this could lead to a retest of the downtrending Gann angle at 7623.00. Overtaking this angle, will indicate the buying is getting stronger. This could create the momentum needed to challenge the minor top and Fibonacci level at 7654.50.

Look for sellers on the first test of 7654.50. However, prepare for an acceleration to the upside if buyers can take out this level. The next target is a resistance cluster at 7751.50.

Bearish Scenario

A sustained move under 7584.75 will signal the presence of sellers. If they create enough downside momentum then look for the selling to extend into an uptrending Gann angle at 7482.00. We could see a technical bounce on the first test of 7482.00. However, if it fails then look for an acceleration into the major retracement zone at 7422.50 to 7314.75. This is the last support zone before the 7290.00 main bottom.

This article was originally posted on FX Empire

More From FXEMPIRE:

Weekly Wrap – Stats and the U.S – China Trade War Put the Dollar on Top

Forex Daily Recap – Loonie Bears Took Charge Amid Trade Settlement Uncertainties

Bitcoin Cash – ABC, Litecoin and Ripple Daily Analysis – 18/05/19

Silver Price Forecast – Silver markets break down again on Friday

Silver Weekly Price Forecast – Silver markets fall through support

Natural Gas Price Forecast – Natural gas markets chop back and forth on Friday