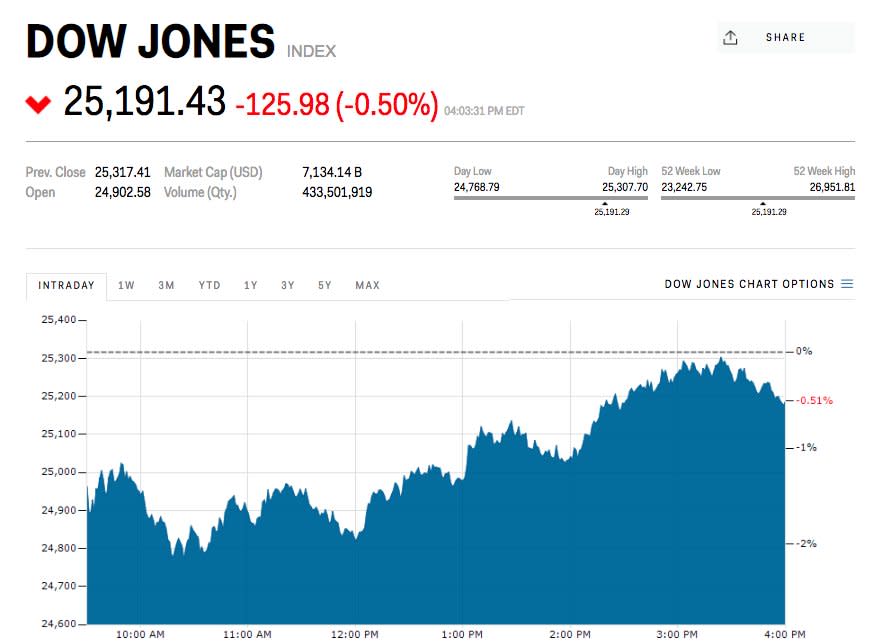

The Dow dropped more than 500 points before erasing most of its losses

Markets Insider

US stocks fell sharply Tuesday morning as geopolitical tensions and the prospect of slowing growth rattled investors.

Shares trimmed their losses throughout the day, and closed with modest losses.

Wall Street shuddered Tuesday morning, mirroring a risk-off sentiment around the world, as geopolitical tensions and the prospect of slowing economic growth continued to rattle investors.

The Dow dropped 2%, or more than 525 points — in the first hour of trading — before erasing its losses over the remainder of the session. The Nasdaq composite fell 2.6% at its worst levels, and the S&P 500 was down 2.1%. All three of the major averages finished with losses of between 0.3% and 0.6%.

"There weren't any major new developments overnight," David Lefkowitz, senior Americas equity strategist at UBS, said in an email. "Instead, the market continues to be focused on some of the macro issues that have been weighing on the market for the past few weeks including higher interest rates, trade frictions, and pockets of softness in the global economy."

Industrial companies sank after corporate earnings in the sector disappointed. 3M (-4.23%) missed on both the top and bottom line and slashed its profit forecast for the year. Caterpillar (-7.47%) beat profit expectations but lowered its guidance, warning tariffs would push up its costs.

"Earnings results have been good, but not quite as strong as recent quarters," Lefkowitz added. "In the US, results this morning from industrial bellwethers have been mixed, with the outlook highly dependent on specific consumer markets and exposure to cost inflation."

Across the Atlantic, European stocks dropped to their lowest level in two years as Italy's plans to sharply increase public spending continued to rattle the region. Officials in Brussels have been pushing back against the populist government in Rome, calling the budget an unprecedented breach of European Union fiscal rules. The pan-European Stoxx 600 fell more than 1.5% to levels not seen since December 2016.

That came after a two-day recovery in Shanghai lost steam, giving way to fears about a slowing economy. After decade-low gross domestic product figures battered Chinese stocks, the government jumped in with promises to prop up equities on Friday. But that failed to settle nerves for long, with the Shanghai composite closing down 2.2% on Tuesday.

Investors flocked to the relative safety of US government bonds, with the 10-year yield falling nearly seven basis points to 3.126% at session lows. It finished down three basis points to below 3.17%. Gold, another safehaven, rose more than 1% in early trading, to a three-month peak at $1,239.84 an ounce.

Elsewhere, oil sank more than 5% to its lowest level since August after Saudi Arabia's energy minister reportedly said OPEC is in "produce as much as you can mode." The American Petroleum Institute, an industry group, is expected to report US crude inventories later Tuesday. Earlier this week, Saudi Arabia said it would not resort to an oil embargo in a rift with Washington.

Now read:

NOW WATCH: 4 lottery winners who lost it all

See Also:

SEE ALSO: Caterpillar beats, says it sees higher costs ahead (CAT)