DoorDash dethrones Grubhub in food delivery battle

There’s a new leader in the highly competitive food delivery space.

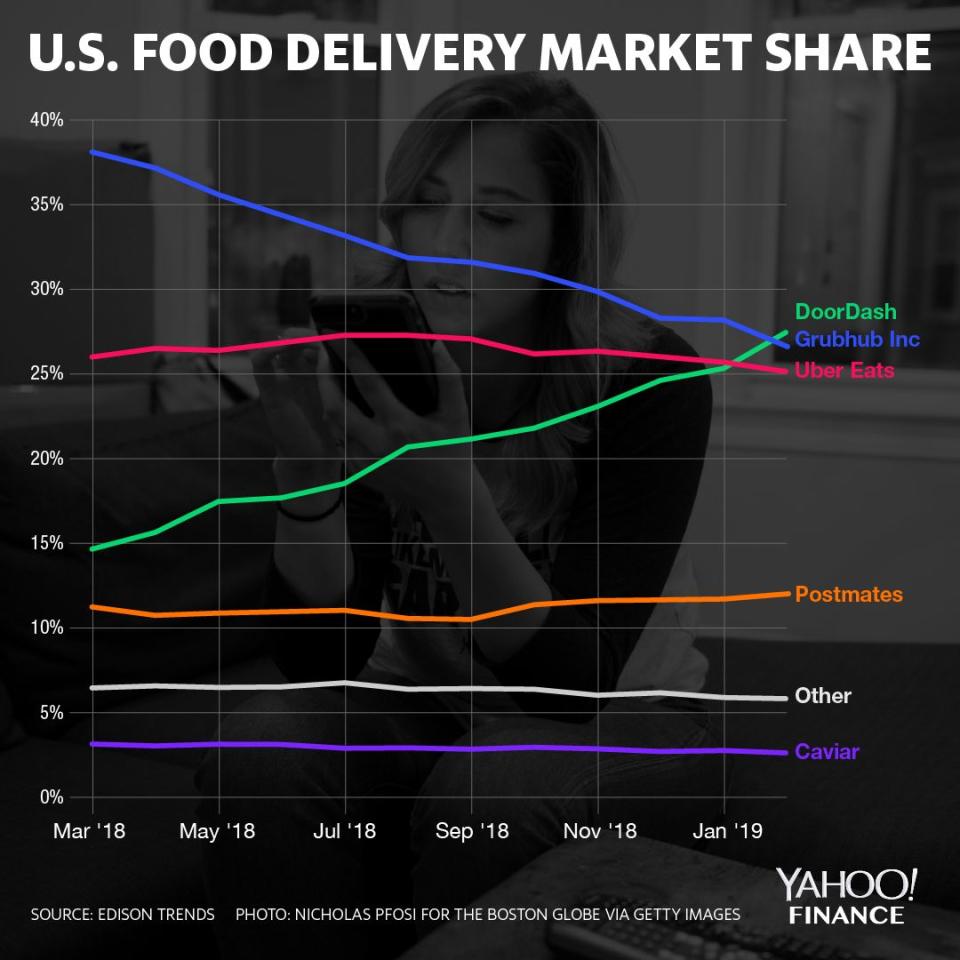

SoftBank-backed delivery startup DoorDash recently surpassed Grubhub for the first time to take the largest share of U.S. food delivery spend, according to a new report from Edison Trends.

DoorDash nearly doubled its market share over last year to 28% through February, which also marked the month the startup closed a $400 million Series F funding round at a $7.1 billion valuation. Over the same time period, publicly traded Grubhub suffered an 11% loss in market share, according to the report, dropping from accounting for nearly 40% to just 27% of total U.S. delivery spend.

As Yahoo Finance reported last year, DoorDash finished 2018 as the fastest-growing delivery service in the country. With its latest funding round, which followed the $535 million round led by SoftBank that valued the company at $1.4 billion in March 2018, and a $250 million round in August that more than doubled its valuation to $4 billion, DoorDash remains flush with cash and shows no signs of slowing.

Fellow private startup Postmates, which was founded in 2011 and raised $300 million last summer in a round led by investment firm Tiger Global, which valued it at $1.2 billion, maintained its share of about 12% of the U.S. market. Uber Eats, the food delivery arm of ride-hailing firm Uber, also saw its share remain roughly unchanged in the same year period, according to Edison Trends.

Shares of Chicago-based Grubhub are about flat to start the year, but are up about 114% since its 2014 initial public offering. Grubhub is the only major food delivery app listed on public markets and investors have speculated that DoorDash could follow with an IPO of its own this year, however. The company did not immediately return a request for comment.

A Grubhub spokesperson emphasized a healthy skepticism in drawing conclusions from the Edison Trends report, which uses a data set that came from millions of e-receipts from U.S. consumers. The spokesperson also noted that market share doesn’t reflect the whole state of the delivery market.

“The only way to create true value for ordering and delivery providers comes in the ability to connect diners and restaurants in a manner that benefits everyone,” Grubhub’s vice president of communications wrote in an e-mail to Yahoo Finance. “This is how we’ve built a business with a five-year track record of generating real cash flow for investors.”

Grubhub counts more than 150 partnerships with national restaurant chains as a major factor contributing to quarter-over-quarter record growth and has plans to invest roughly $400 million more to lock up new deals as more delivery companies vie for ways to differentiate themselves.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Where SoftBank’s Vision Fund is deploying its $100 billion

Why 2019's IPO outlook is bleaker than it should be

Juul surpasses Facebook as fastest startup to reach decacorn status