What Does Openjobmetis SpA’s (BIT:OJM) PE Ratio Tell You?

This analysis is intended to introduce important early concepts to people who are starting to invest and want to learn about the link between company’s fundamentals and stock market performance.

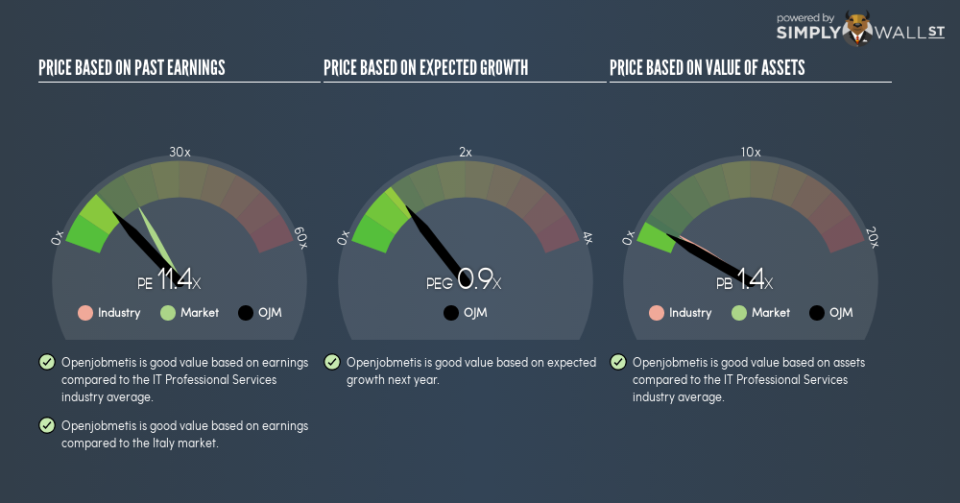

Openjobmetis SpA (BIT:OJM) trades on a trailing P/E of 11.4. This isn’t too far from the industry average (which is 11.5). Although some investors may jump to the conclusion that this is a great buying opportunity, understanding the assumptions behind the P/E ratio might change your mind. In this article, I will break down what the P/E ratio is, how to interpret it and what to watch out for.

See our latest analysis for Openjobmetis

Breaking down the Price-Earnings ratio

The P/E ratio is one of many ratios used in relative valuation. It compares a stock’s price per share to the stock’s earnings per share. A more intuitive way of understanding the P/E ratio is to think of it as how much investors are paying for each dollar of the company’s earnings.

P/E Calculation for OJM

Price-Earnings Ratio = Price per share ÷ Earnings per share

OJM Price-Earnings Ratio = €9.6 ÷ €0.841 = 11.4x

The P/E ratio itself doesn’t tell you a lot; however, it becomes very insightful when you compare it with other similar companies. Our goal is to compare the stock’s P/E ratio to the average of companies that have similar attributes to OJM, such as company lifetime and products sold. One way of gathering a peer group is to use firms in the same industry, which is what I’ll do. Openjobmetis SpA (BIT:OJM) is trading with a trailing P/E of 11.4, which is close to the industry average of 11.5. This multiple is a median of profitable companies of 4 Professional Services companies in IT including Tecnoinvestimenti, Technical Publications Service and CdR Advance Capital. One could put it like this: the market is pricing OJM as if it is roughly average for its industry.

Assumptions to watch out for

However, there are two important assumptions you should be aware of. The first is that our “similar companies” are actually similar to OJM, or else the difference in P/E might be a result of other factors. For example, if you are comparing lower risk firms with OJM, then its P/E would naturally be lower than its peers, as investors would value those with lower risk at a higher price. The second assumption that must hold true is that the stocks we are comparing OJM to are fairly valued by the market. If this does not hold, there is a possibility that OJM’s P/E is lower because our peer group is overvalued by the market.

What this means for you:

If your personal research into the stock confirms what the P/E ratio is telling you, it might be a good time to add more of OJM to your portfolio. But keep in mind that the usefulness of relative valuation depends on whether you are comfortable with making the assumptions I mentioned above. Remember that basing your investment decision off one metric alone is certainly not sufficient. There are many things I have not taken into account in this article and the PE ratio is very one-dimensional. If you have not done so already, I urge you to complete your research by taking a look at the following:

Future Outlook: What are well-informed industry analysts predicting for OJM’s future growth? Take a look at our free research report of analyst consensus for OJM’s outlook.

Past Track Record: Has OJM been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of OJM’s historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.