You Should Diversify With These Energy Dividend Stocks

The energy industry is highly dependent on commodity prices, making its profits and cash flows sensitive to the economic cycle. However, as oil rebounded from its multi-year lows, certain energy companies are in position to earn profits. Subsequently, shareholders have growing expectations that dividend payments could increase as cash flow recovers at these companies. Here are my top dividend stocks in the energy industry that could be valuable additions to your current holdings.

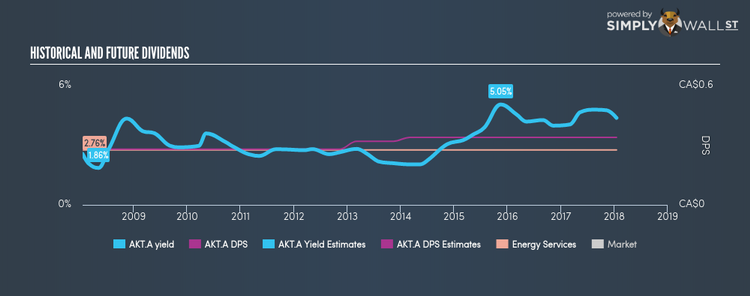

AKITA Drilling Ltd. (TSX:AKT.A)

AKT.A has a great dividend yield of 4.38% and a reasonably sustainable dividend payout ratio . AKT.A’s DPS have risen to $0.34 from $0.28 over a 10 year period. It should comfort existing and potential future shareholders to know that AKT.A hasn’t missed a payment during this time. Over the next year, analysts are estimating a double digit EPS growth of 32.85%. More on AKITA Drilling here.

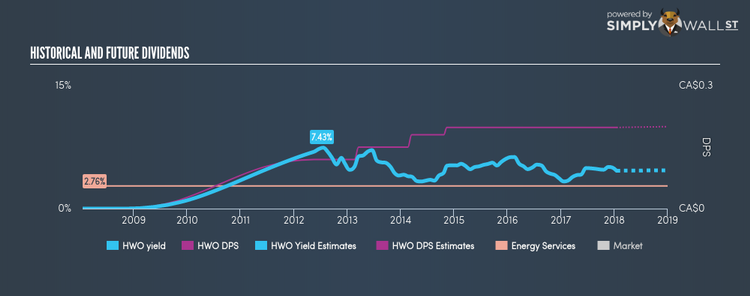

High Arctic Energy Services Inc (TSX:HWO)

HWO has a substantial dividend yield of 4.63% and is paying out 42.95% of profits as dividends . Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. Comparing High Arctic Energy Services’s PE ratio against the CA Energy Services industry draws favorable results, with the company’s PE of 9.4 being below that of its industry (22). More on High Arctic Energy Services here.

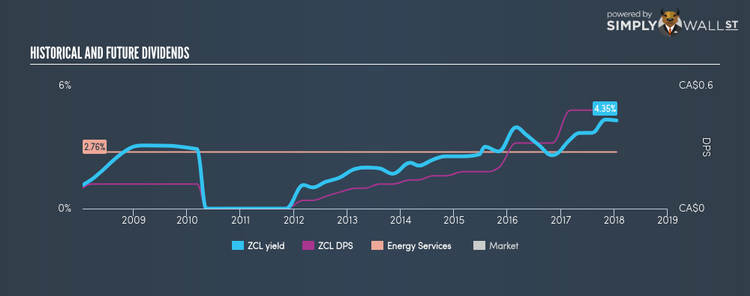

ZCL Composites Inc. (TSX:ZCL)

ZCL has an alluring dividend yield of 4.30% and the company currently pays out 82.13% of its profits as dividends . Despite some volatility in the yield, DPS has risen in the last 10 years from $0.1 to $0.48. Comparing ZCL Composites’s PE ratio against the CA Energy Services industry draws favorable results, with the company’s PE of 19.1 being below that of its industry (22). More on ZCL Composites here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.