Crypto crisis: a year on from its record high, is this the end of the road for Bitcoin?

Last year, Christmas came early for Bitcoin investors.

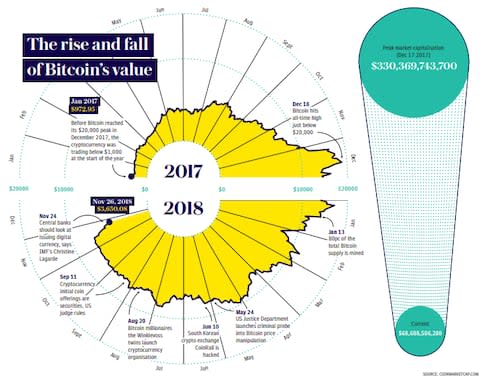

As the 2017 holiday season loomed into view exactly one year ago, cryptocurrency investors were surfing a wave of optimism, which sent the digital currency cruising to an all-time high. In the first 17 days of December alone, its price more than doubled to $20,000.

Across the board, the valuation of cryptocurrencies was surging, helping tempt new investors that the hype was for real as portfolios swelled.

For people inside the cryptocurrency bubble, soaring valuations offered proof that their investments were paying off. In fact, so many cryptocurrency enthusiasts purchased high-end sports cars that it became a running joke online. “When Lambo?” people asked whenever a new cryptocurrency project was launched.

But a year later, the atmosphere could not be more different.

The digital currency has collapsed in spectacular fashion, with almost $250bn being wiped off Bitcoin's total market cap since December, while deepening woes have caused prices to sink below $4000 for the first time since September 2017.

On Saturday, Nouriel Roubini, the US economist who famously predicted the 2008 financial crash, offered a damning perspective, describing Bitcoin as "the biggest bubble [and] bust in history", exceeding even the South Sea bubble and the tulip mania of the 1630s.

So what exactly happened? And is it really curtains for the crypto market, as Roubini and many others believe?

Accusations of market manipulation haven't helped, of course. They cast a pall around a cryptocurrency industry that was already being treated with caution, given its origins as a merry band of outsiders thumbing their collective nose at the stodgy world of conventional finance.

In the US, federal prosecutors are investigating a cryptocurrency named Tether, which claims to be pegged to the US dollar, over accusations that the alternate currency was used to manipulate the price of Bitcoin.

Prosecutors claim that some of Bitcoin’s 2017 rally to its all-time high of $20,000 was down to traders using Tether to buy up Bitcoin at crucial moments.

Earlier this year, researchers published a paper which sought to link the rise in Bitcoin’s price to suspicious market activity using Tether. Claims of artificial manipulation of Bitcoin’s price have been troubling to institutional investors considering a move into Bitcoin.

But market manipulation isn’t the only issue faced by Bitcoin, however. The wider cryptocurrency community has recently been grappling with a “hard fork” of cryptocurrency Bitcoin Cash.

A “fork” is tantamount to a breakup. Last year, a group of developers grew frustrated with rising operational costs in Bitcoin and the limits on what’s known as the “blocksize” of data held on the blockchain.

They saw an opportunity to break away from Bitcoin by preparing a code change that would lead to the development of Bitcoin Cash, a new cryptocurrency spun off from Bitcoin that leveraged the name of the original. It held the promise of delivering on the features they thought Bitcoin should really be delivering.

But no path is free from bumps in the road. The newly formed Bitcoin Cash, which is barely a year old, experienced another “hard fork” mid-November that split it into Bitcoin Cash ABC and Bitcoin Cash SV.

According to Iqbal Gandham, UK managing director of crypto trading platform eToro, the recent shifts in price were inevitable given the fork. Market analysts were waiting for a sharp downturn in cryptocurrencies mid-November following a period of stability at around $6000 - in part due to the general performance of tech stocks globally in recent weeks, compounded by the uncertainty injected by the Bitcoin Cash divide.

“This issue of Bitcoin Cash forking also occurring at the time around the 14th or 15th [of November] has caused the movement down,” says Gandham. “It’s ‘two tribes go to war’ kind of thing.”

To further complicate matters for the industry, regulators in the UK have also begun to place focus on Bitcoin. Members of Parliament have urged the Financial Conduct Authority to extend its Regulated Activities Order to also cover cryptocurrencies such as Bitcoin.

The government’s Cryptoasset Taskforce, which is comprised of the Financial Conduct Authority, HM Treasury and the Bank of England, has recommended holding a consultation in early 2019 on whether so-called Initial Coin Offerings should be regulated. This is a process that involves the offering of digital coins for sale from startups launching new cryptocurrencies.

Signs of impending regulation on cryptocurrencies in the UK have concerned investors, with experts publishing a report alleging that overzealous regulation could harm cryptocurrency traders in the UK.

“If you crowbar everything into the Regulated Activities Order you are making everything into an investment bank,” said Neil Foster, corporate technology partner at Baker Botts.

It’s hard to see how Bitcoin recovers in a year when Bank of England Governor Mark Carney warned that the digital coin was “failing” as a currency, and had become a “global speculative mania” that “exhibited all the classic hallmarks of bubbles”.

But not everyone is running for the hills just yet. There are signs that the industry can survive and win over at least some key players in traditional finance.

Earlier this month, Christine Lagarde, managing director of the International Monetary Fund, made a serious proposal for central banks to issue digital currencies at a fintech event in Singapore.

The Winklevoss twins, two brothers who have made fortunes from their Bitcoin investments, remain bullish on the future prospects of the market, while a more mature approach to digital coins like Tether being pegged to fiat currencies is taking shape in what’s known as Stablecoins.

Buying still seems to be occurring too in over the counter markets run by major institutions and exchanges.

Though Gandham sees Bitcoin falling further still, with a levelling of price possible at the $2500 mark, he is keen to see what happens this December as less-experienced investors are shaken out. As time marches on, he says, regulation will become concrete, offering a new wave of enthusiasts a chance to participate within a safe investment environment.

“The people who bought in September 2017 when we saw the huge rise, I’m sure there is a certain amount of concern among them. But the industry itself is still moving forward towards its goal saying ‘we still believe in this’” he says.

“The ones who really understand the power of Bitcoin and the power of blockchain realise this is not something that's going to disappear. I don't think traditional finance is going to miss the opportunity again.”