Crude Oil Price Update – Look for Big Rally if $48.04 is Taken Out With Conviction

October West Texas Intermediate crude oil futures are trading higher shortly before the regular session opening and today’s U.S. Energy Information Administration’s weekly inventories report. Traders are expecting the report to show a 3.0 million barrel draw. However, investors should pay close attention to the gasoline numbers. They should move the market.

Today’s early strength is coming from yesterday’s American Petroleum Institute (API) report. The report showed a major draw of 9.2 million barrels in the week-ending August 11. This was the biggest draw since September 2016. Analysts were looking for a draw of only 3.6 million barrels.

Once again the upside was limited by a surprise build in gasoline inventories. They rose by 301,000 according to the API. Traders had priced in a 1.5 million barrel draw.

Technical Analysis

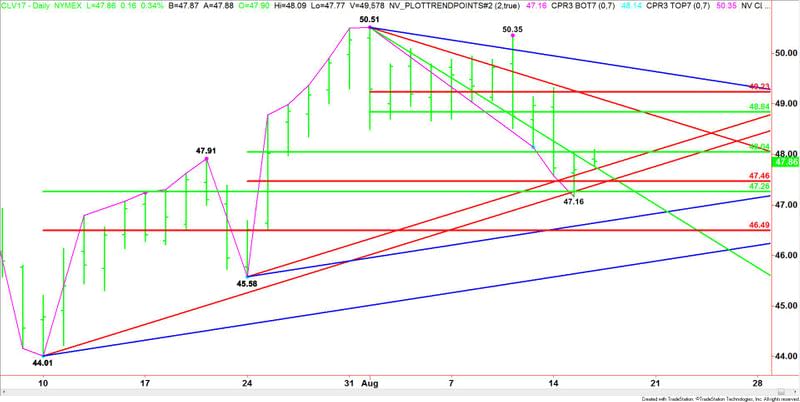

The main trend is up according to the daily swing chart, however, momentum has been trending lower for about eleven days. Despite the prolonged move down in terms of price and time, all the market has done is complete a normal 50% to 61.8% retracement of its late July to early August range.

The short-term retracement zone is $48.04 to $47.46. The longer-term range is $47.26 to $46.49. The combination of the two ranges forms a support area at $47.46 to $47.26. This zone was successfully tested on Tuesday.

A new short-term range may be forming between $50.51 and $47.16. If the upside momentum resumes then its retracement zone at $48.84 to $49.23 will become the primary upside target.

Forecast

Based on the current price at $47.87 and the early price action, the direction of the crude oil market today will be determined by trader reaction to $48.04.

A sustained move over $48.04 could trigger an acceleration to the upside with the next upside targets coming in at $48.84, $49.14 and $49.23.

A sustained move under $48.04 could lead to a labored break with possible targets $47.71, $47.46, $47.39, $47.26 and $47.16.

If the market can claw its way through the cluster of numbers then look for an acceleration to the downside if $47.16 is taken out. The next targets under this level are $46.64 and $46.49.

This article was originally posted on FX Empire