Buy These Stocks Before the June Fed Meeting

The Federal Open Market Committee (FOMC) will hold its two-day policy meeting next week, with the central bank's interest rate decision due at 2 p.m. ET on Wednesday, June 19. While CME Group's FedWatch tool pegs the odds of a Fed rate cut at just 24.2% this time around, traders will undoubtedly dissect post-meeting comments from Fed Chair Jerome Powell for more hints of a July rate cut, the odds of which currently sit at 83.7%. And while Fed week tends to be bearish for the broader stock market, we decided to take a look at the best stocks to own during these weeks, historically, as well as the best stocks for Fed announcement day.

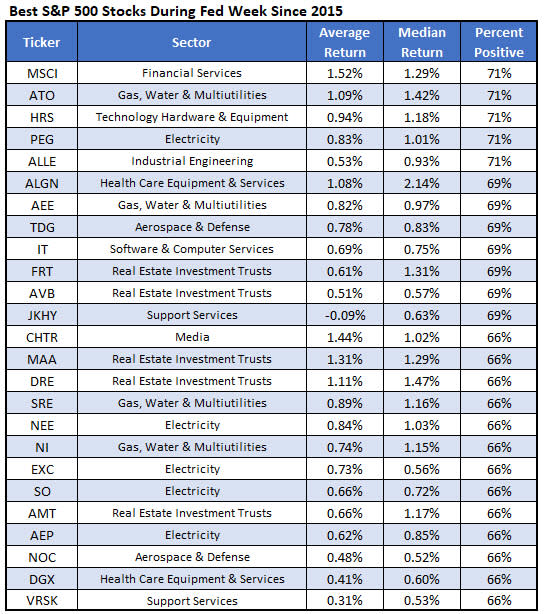

Below are the 25 best stocks to own the week of Fed policy meetings, looking at data since 2015, which encompasses 35 meetings. Equities needed at least 25 returns to be considered, with the list cultivated by Schaeffer's Senior Quantitative Analyst Rocky White. At the top of the list was stock market platform provider MSCI Inc (NYSE:MSCI).

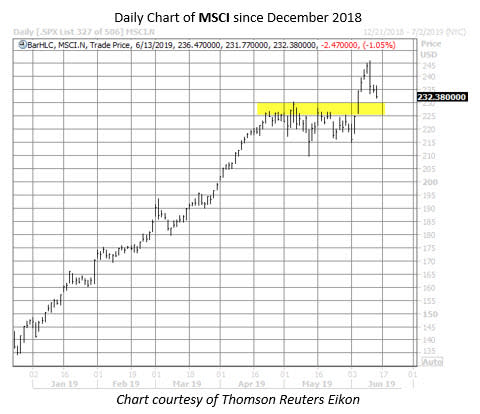

Specifically, MSCI has ended Fed week higher 71% of the time, averaging a one-week gain of 1.52% -- better than any other eligible S&P 500 stock. The shares have been on fire so far in 2019, advancing nearly 58% and notching a record peak of $246.07 just this past Tuesday, June 11. Since then, MSCI has pulled back to trade at $232.38, and could find support in the $225-$230 area, which acted as a ceiling in April and May.

An unwinding of bearish options bets could add fuel to the security's fire. While absolute volume tends to run light on MSCI, options buyers have picked up nearly two puts for every call during the past two weeks on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio registers in the 82nd percentile of its annual range, pointing to a healthier-than-usual appetite for bearish bets over bullish.

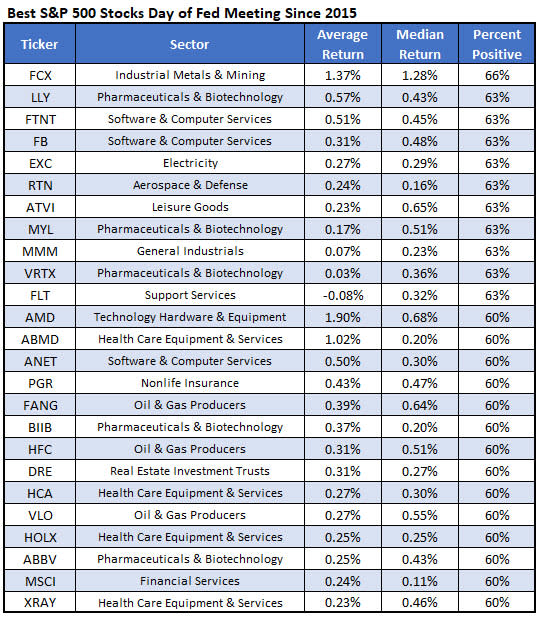

Moving on, White also looked at individual stock returns on the day the Fed announces its policy decision -- which will be Wednesday, June 19, this month. Since 2015, the 25 stocks below have outperformed on these days, considering equities with at least 25 historical returns. As you can see, semiconductor concern Advanced Micro Devices, Inc. (NASDAQ:AMD) has generated the highest average return on Fed days.

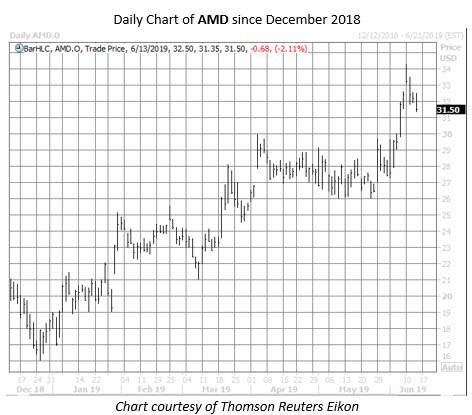

Specifically, AMD has averaged a one-day gain of 1.9% on Fed decision days, ending higher 60% of the time. On the charts, the chip stock has skyrocketed more than 70% already in 2019, and surged to a 13-year high of $34.30 on June 10, thanks to a bullish analyst note. Since then, the shares have cooled their proverbial jets, last seen testing their footing around $31.50.

Traders expecting AMD to resume its long-term rally and once again jump on Fed day should consider short-term options, which are attractively priced. The equity's Schaeffer's Volatility Index (SVI) of 52% is in the 18th percentile of its annual range, suggesting near-term options are pricing in relatively low volatility expectations for AMD shares. In addition, the stock's Schaeffer's Volatility Scorecard (SVS) stands at 93 (out of a possible 100), indicating the shares have handily exceeded options traders' volatility expectations in the past year.