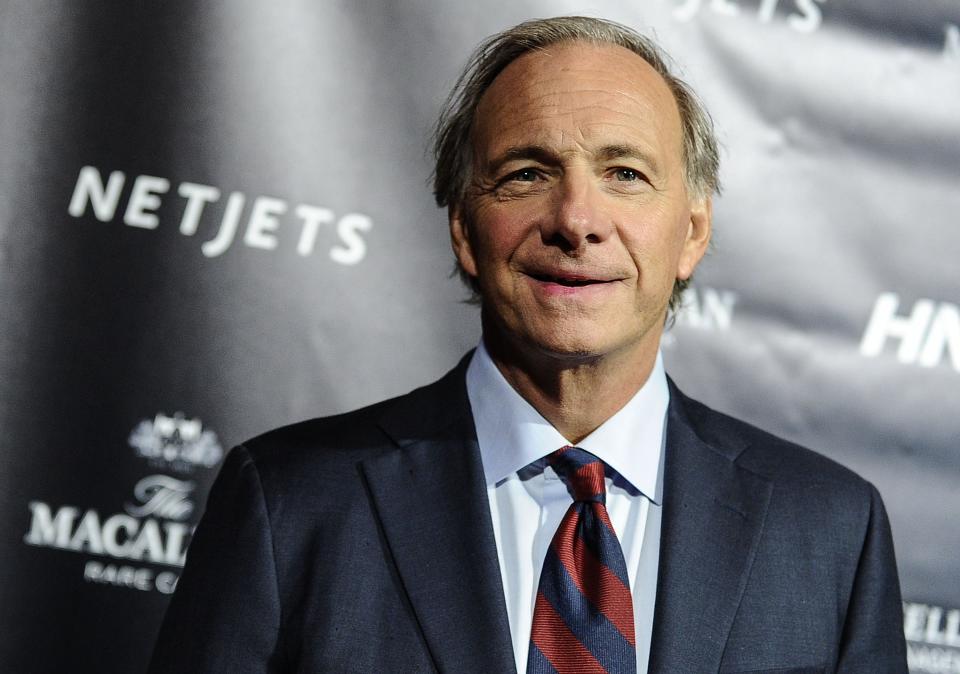

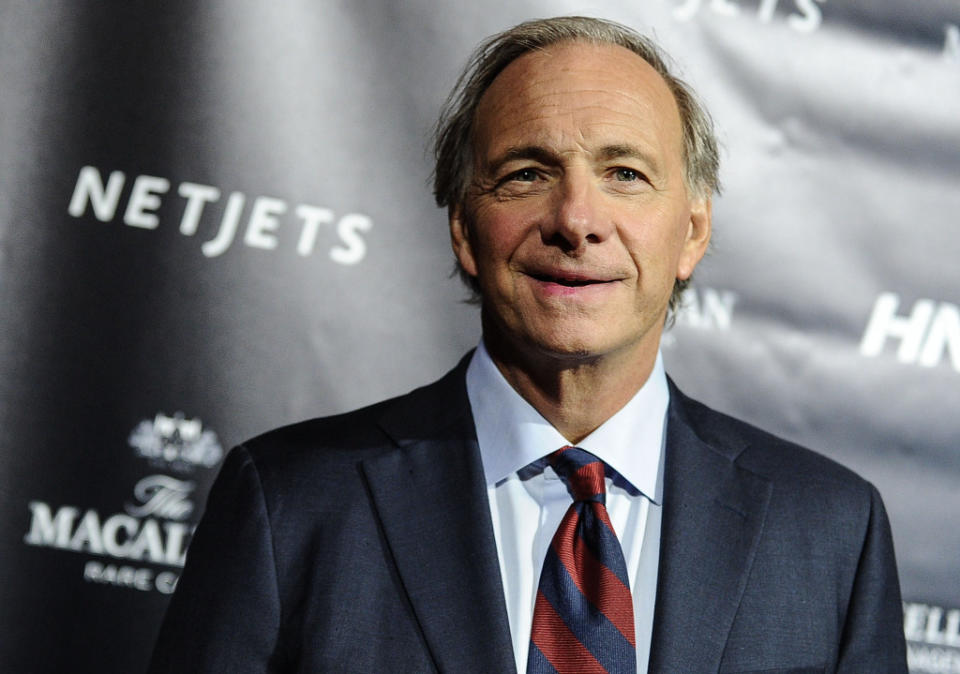

Bridgewater’s Founder Just Explained Why 3 in 5 Americans Are Struggling

The founder of the world's largest hedge fund has serious concerns about the U.S. economy.

In a LinkedIn note published Monday, Ray Dalio, who founded Bridgewater Associates, said that average statistics about what's going on in the economy mask deep divisions that could lead to "dangerous miscalculations."

To explain this divide, Dalio splits up the economy into two separate sections: the top 40% and the bottom 60%. He then runs through a number of different statistics showing that the economy for the bottom 60% of the population -- or three in five Americans -- is much less stable than that for those in the top bracket.

For example, Dalio notes that, since 1980, real incomes have been flat or down for the average household in the bottom 60%. Those in the top 40% also now have an average of 10 times as much wealth as households in the bottom 60% -- an increase from six times as much in 1980.

Other points include that only about one-third of people in the bottom 60% save any of their income and a similar number have retirement savings accounts. These three in five Americans have also seen an increasing rate of premature death and spend an average of four times less on education than those in the top 40%, Dalio wrote. Those without a college education see lower income rates and higher divorce rates.

Dalio wrote that all of these concerns will likely intensify in the next five to 10 years, and that he believes policy makers need to take them into consideration. Dalio added that if he were running the Federal Reserve, he would "keep an eye on the economy of the bottom 60%."

The hedge fund founder has been sounding the alarm for a while. In September, Business Insider reported that Bridgewater told clients the Fed was making a mistake by raising interest rates. With this latest note, he doubles down on this idea that the economy is not as healthy as it seems, and says his company will continue to report on the 60% and the 40% separately.

See original article on Fortune.com

More from Fortune.com

World's Top Hedge Fund Predicts U.S. Stocks Will Drop if Donald Trump Is Impeached

The Founder of the World's Biggest Hedge Fund Has a Bleak Warning About Trump's Policies

The World's Biggest Hedge Fund is Embedding Its Founder's Brain in an Algorithm

Bridgewater's Ray Dalio Says Fed Doesn't Need To Raise Interest Rates