Bitcoin Ridiculously Overbought – One Trader Says it Will Still Go ‘Parabolic’

Now that the bitcoin price has broken above the $5,000 mark to set a new 2019 high, crypto traders are anxiously watching the charts to discern whether the flagship cryptocurrency will slaughter its next major resistance wall at $6,000 to triumphantly initiate a new bull market.

Below, we dive into the bull and bear cases for bitcoin as traders grapple to maximize their profits when the cryptocurrency embarks on its next major move.

Bear Case: Bitcoin Hasn’t Been This Overbought Since December 2017

After falling as low as $4,778 on Thursday, the bitcoin price is currently holding slightly below $5,000 on Bitstamp.

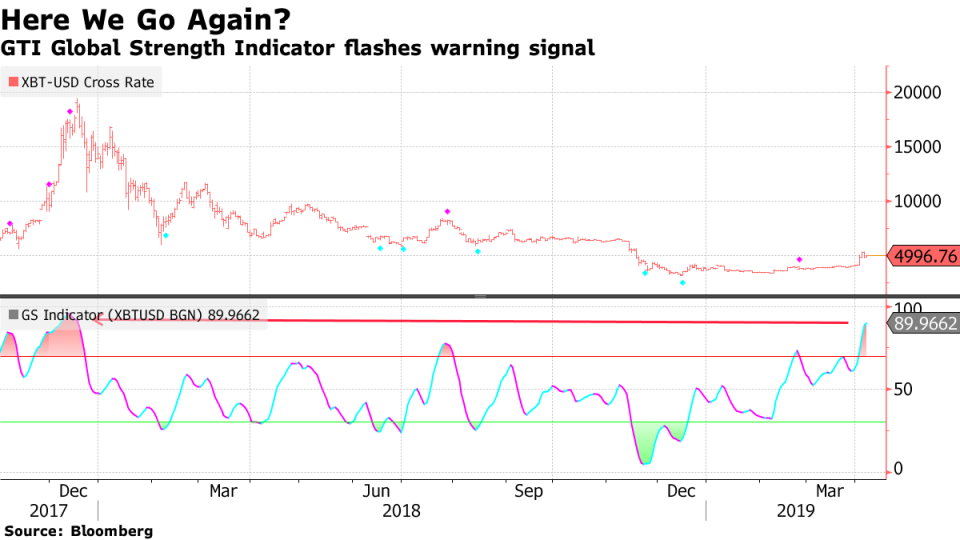

Citing a technical tool called the GTI Global Strength Indicator, Bloomberg technical analyst Mike McGlone warns that bitcoin is currently at its most overbought since December 2017 when it was neck-deep in a rally that carried it as high as $19,891 before its historic crash.

According to one metric, bitcoin hasn’t been this expensive since December 2017. | Source: Bloomberg

“The market got so compressed, volatility was so low, it just went poof! It broke out. It was released from the cage,” McGlone commented in a Bloomberg analysis piece. “Now it’s a question of duration and I suspect when you have such a massive bubble, you’ll always have an overhang of people who need to sell.”

Adding to the bear case, David Tawil told Bloomberg that bitcoin’s 20 percent surge past $5,000 was “not a particularly comforting move” and that he expects to see a near-term sell-off.