Best Growth Stock in May

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

NovoCure Limited (NASDAQ:NVCR)

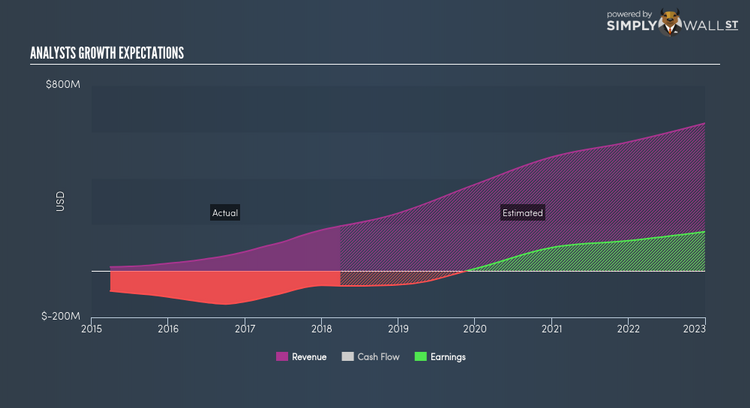

NovoCure Limited engages in the development, manufacture, and commercialization of Tumor Treating Fields for the treatment of solid tumors. Started in 2000, and run by CEO Asaf Danziger, the company provides employment to 495 people and with the company’s market cap sitting at USD $2.72B, it falls under the mid-cap group.

Driven by exceptional sales, which is expected to more than double over the next few years, NVCR is expected to deliver an excellent earnings growth of 64.52%. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. NVCR’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering NVCR as a potential investment? I recommend researching its fundamentals here.

Palo Alto Networks, Inc. (NYSE:PANW)

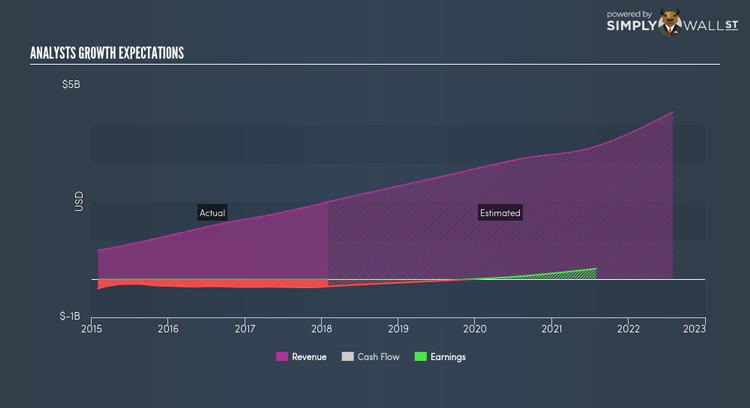

Palo Alto Networks, Inc. provides security platform solutions worldwide. Started in 2005, and run by CEO Mark McLaughlin, the company now has 4,833 employees and with the market cap of USD $18.58B, it falls under the large-cap category.

PANW’s projected future profit growth is an exceptional 76.34%, with an underlying 44.52% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of PANW, it does not appear extreme. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 48.18%. PANW’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in PANW? Check out its fundamental factors here.

Glu Mobile Inc. (NASDAQ:GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of free-to-play mobile games for the users of smartphones and tablet devices. Founded in 2001, and now run by Nick Earl, the company currently employs 546 people and with the stock’s market cap sitting at USD $758.35M, it comes under the small-cap stocks category.

Extreme optimism for GLUU, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by a double-digit sales growth of 38.52%. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 28.22%. GLUU’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add GLUU to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.