Best Cheap Stocks To Buy

Skellerup Holdings and Livestock Improvement are stocks on my list that are potentially undervalued. This means their current share prices are trading well-below what the companies are actually worth. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. If you’re looking for capital gains in your next investment, I suggest you take a look at my list of potentially undervalued stocks.

Skellerup Holdings Limited (NZSE:SKL)

Skellerup Holdings Limited manufactures, markets, and distributes technical polymer products and vacuum pumps for various specialist industrial and agricultural applications. Skellerup Holdings was established in 1910 and has a market cap of NZD NZ$348.98M, putting it in the small-cap stocks category.

SKL’s stock is currently hovering at around -20% lower than its actual value of $2.27, at a price of NZ$1.81, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy SKL shares at a low price. Furthermore, SKL’s PE ratio is trading at around 14.03x while its Machinery peer level trades at, 24.03x suggesting that relative to its peers, you can purchase SKL’s stock for a lower price right now. SKL is also strong in terms of its financial health, with near-term assets able to cover upcoming and long-term liabilities.

Interested in Skellerup Holdings? Find out more here.

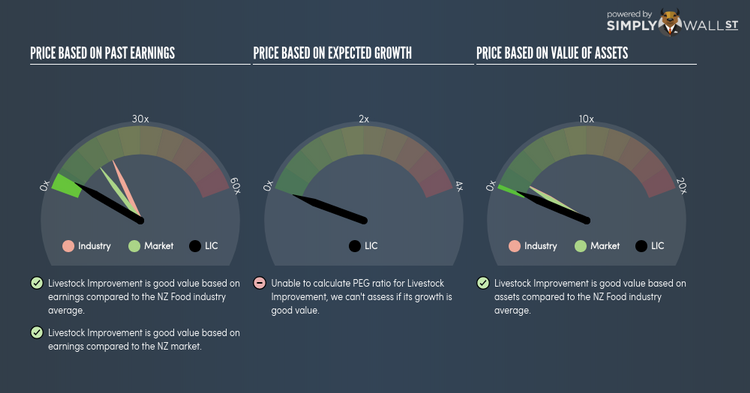

Livestock Improvement Corporation Limited (NZSE:LIC)

Livestock Improvement Corporation Limited, together with its subsidiaries, develops, produces, and markets artificial breeding, genetics, farm software, farm automation, and herd testing services. Livestock Improvement was started in 1909 and has a market cap of NZD NZ$88.59M, putting it in the small-cap stocks category.

LIC’s stock is now hovering at around -72% less than its intrinsic level of $10.56, at the market price of NZ$3.00, according to my discounted cash flow model. This mismatch signals an opportunity to buy LIC shares at a discount. Moreover, LIC’s PE ratio is currently around 4.31x against its its Food peer level of, 19.45x meaning that relative to its competitors, LIC can be bought at a cheaper price right now. LIC is also strong in terms of its financial health, with near-term assets able to cover upcoming and long-term liabilities.

Dig deeper into Livestock Improvement here.

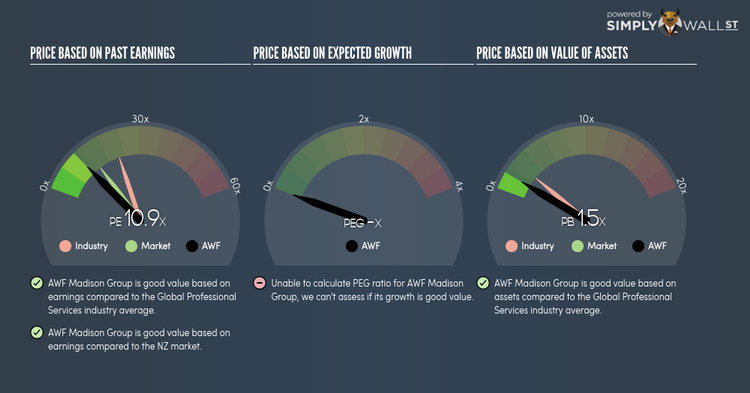

AWF Madison Group Limited (NZSE:AWF)

AWF Madison Group Limited provides recruitment and staffing services in New Zealand. Established in 1988, and now led by CEO Simon Bennett, the company currently employs 258 people and with the market cap of NZD NZ$58.52M, it falls under the small-cap stocks category.

AWF’s shares are now hovering at around -77% lower than its intrinsic value of $7.96, at a price of NZ$1.80, based on its expected future cash flows. signalling an opportunity to buy the stock at a low price. Additionally, AWF’s PE ratio is trading at around 10.92x while its Professional Services peer level trades at, 22.12x indicating that relative to its peers, you can buy AWF for a cheaper price. AWF is also a financially healthy company, with short-term assets covering liabilities in the near future as well as in the long run.

Interested in AWF Madison Group? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.