Bernie Madoff's lawyer remembers the moment he learned of the $65 billion Ponzi scheme

Ike Sorkin remembers December 11, 2008, like it was yesterday. He was at his granddaughter’s nursery school watching the teacher ask children about the sounds farm animals make. But Sorkin was about to learn the chickens had just come home to roost for Bernie Madoff.

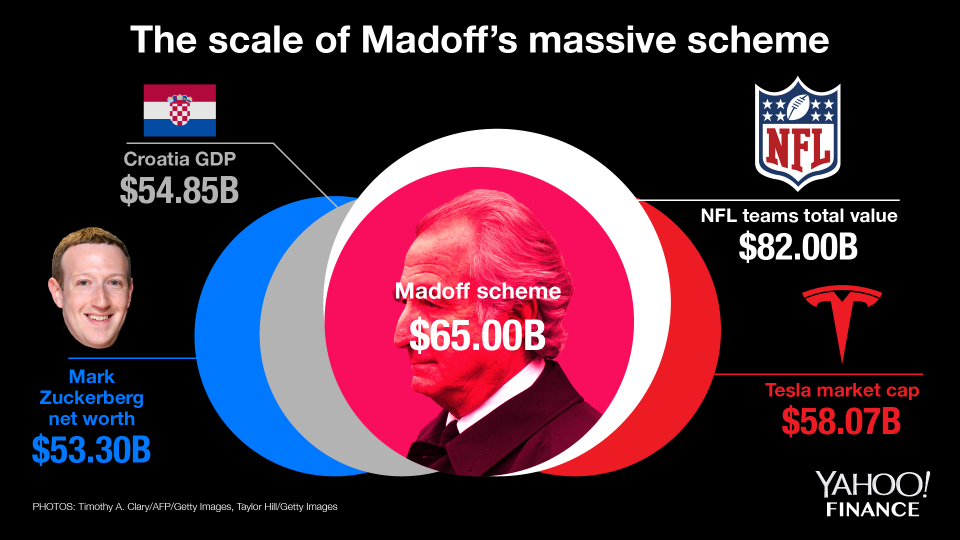

“I pick up the cell phone, in the classroom, and the conversation was, Ike, I need your help. I’m handcuffed to a chair at FBI Headquarters.” Thus began Sorkin’s role as defense attorney in Madoff’s epic tragedy, the implosion of the world’s largest Ponzi scheme, $65 billion dollars.

Within a few hours of that phone call, thousands of people across the world learned they had individually lost hundreds of thousands, in some cases millions, of dollars. Some were completely wiped out. Others like Manhattan attorney Helen Chaitman lost every penny they had saved for retirement.

“I was standing at the kitchen sink in my daughter’s apartment washing my grandson’s dinner dishes and I grabbed on to the edge of the sink because I thought I was going to faint,” Chaitman recalls about first learning about Madoff’s scheme. She would go on to defend other Madoff victims in court and before Congress, attempting to recover money they needed desperately to live.

The list of Madoff victims includes Hollywood celebrities director Steven Spielberg, actors Kyra Sedgwick and her husband Kevin Bacon. Charities, including Hadassah ($90 million), Los Angeles Jewish Community Foundation ($18 million), pension funds such as Royal Dutch Shell ($45 million), the Town of Fairfield, Connecticut ($42 million), and Massachusetts Pension Reserve ($12 million), were just a few of the institutional victims. In some cases they didn’t even know they were invested with Madoff.

New York University invested money with hedge fund operator Ezra Merkin unaware that his two funds, Ascot Partners LP and Ascot Fund Ltd. were just feeder funds Madoff used to finance the Ponzi scheme. Merkin lost $110 million of his own money and claims he was unaware of the fraud. His funds’ exposure to Madoff was just a small part of a much larger calamity. Other feeder funds had greater exposure to Madoff, including Fairfield Greenwich Group $7.5 billion, Grupo Santander $3.5 billion, Tremont Group $3.3 billion. The feeder funds solicited money from investors by the thousands without always disclosing the money was being sent directly to Madoff. The eventual carnage would lead to terrible consequences.

Some of Madoff’s business partners at those feeder funds killed themselves. René-Thierry Magon de La Villehuchet was the first. He was a founder of Access International Advisors, with $1.4 billion tied to Madoff, and slit his wrists and bled to death just two weeks after the Ponzi scheme collapsed. Two years later, Madoff’s oldest son Mark committed suicide, hanging himself on the second anniversary of his father’s arrest.

Mark’s younger brother Andrew died in 2014 from cancer. But before he died, Andrew demanded his mother Ruth cut off all contact with her husband Bernie or risk losing all contact with her grandchildren. Ruth complied with her son’s demand. Sources close to Ruth tell Yahoo Finance she now lives in Connecticut and donates her time to charity. Ruth Madoff continues to turn down requests for interviews.

$13 billion recovered

Sorkin says, “There is nothing that I have seen, heard, learned that suggests in any way that the boys and Ruth knew about this.”

But the lawyer entrusted to recover Madoff’s ill-gotten billions disagrees.

Irving Picard, a partner at Baker Hostetler, was appointed Trustee for the liquidation of Bernard L. Madoff Investment Securities almost immediately after Madoff’s arrest. Over the last 10 years, Picard’s team has successfully sued people like Ezra Merkin, funds like Fairfield Greenwich, and the estates of Mark and Andrew Madoff, recovering more than $13 billion. The list is in the thousands and in several cases Picard has had to sue, or threaten to sue, Madoff victims.

Those victims are former Madoff clients who withdrew more from the Madoff operation than they originally invested. Picard calls these people “net winners.” Suing them has proved controversial. The trustee’s office argues that the money “net winners” withdrew did not belong to them, it belonged to Madoff victims known as “net losers,” people who got nothing or far less than their original investment. Federal courts agree with Picard.

The single largest recovery came from the estate of Jeffry Picower, $7.2 billion. He was one of Madoff’s close associates and allegedly dictated, over several years, the gains and losses he expected from Madoff. For instance, between 1996 and 2007, Picower’s returns on various accounts exceeded 100% fourteen times. But Picower never had the chance to explain his phenomenal returns or relationship to Madoff. Almost a year after the scheme imploded, he was found dead at the bottom of his swimming pool in West Palm Beach.

I met Bernie Madoff five years ago at the federal prison he calls home in Butner, North Carolina. He is serving a 150-year sentence. Madoff told me then that he was ashamed of what he did and that he feels remorse for the people he harmed. But it’s hard to know when Madoff is telling the truth. Madoff, in his original confession, said he acted alone. Since then, 15 former Madoff employees have confessed to or been convicted of crimes they committed helping Madoff pull of the largest Ponzi scheme ever. Even Ike Sorkin, Madoff’s lawyer whose family lost money with Bernie Madoff, says Madoff deserves credit for fessing up to the crime and avoiding a trial. “We could have kept him out for another year and then at the eve of the trial, pleaded guilty and he would have gotten the same sentence” Sorkin said.

—

Adam Shapiro is an anchor for Yahoo Finance. Follow him on Twitter @ajshaps.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.