It's All Clicking for Wayfair, a Fortune 500 Newcomer

Not long after graduating from Cornell back in 1995, Niraj Shah and Steve Conine decided to compare their meager bank accounts. Both fresh-faced engineering students who liked talking business, they possessed highly analytical minds and more than their share of pluck and will. But little else. At the time, Conine was up several thousand dollars and so rubbed it in. But Shah was blasé. “We’re going to be so successful,” Conine recalls him saying, that “the difference in our savings today will be irrelevant.”

The nascent dotcom boom was beginning to reveal a vast Internet landscape, and Shah and Conine followed the money. In short order, they built and sold an IT services consulting company and a mobile development shop, earning enough to self-fund, circa 2002, a humble-sounding venture called RacksandStands.com out of a spare bedroom in Conine’s house. It offered anything you could ever want to hold your stereo. They learned quantitative marketing via Google AdWords and bonded with suppliers and distributors. They handled customer service themselves, did their best to ensure that shoppers received their orders on time, and measured everything they could. “In four months, we became one of the largest online sellers of entertainment furniture,” Shah says.

So they replicated the model across 250 or so almost comically vertical segments. JustSouthwesternRugs.com. EveryCuckooClock.com. AllBakersRacks.com. HolidayDecorationsDirect.com. “We spent nine, 10 years building the systems and infrastructure and worried less about the front end until we had operational consistency,” Conine adds. “It’s easy to start an e-commerce site and build a sexy front end. It’s very hard to durably deliver the experience you’re promising.”

Today, Shah and Conine are the CEO and cochairman, respectively, of Wayfair, the world’s 12th-largest online retailer. With $6.8 billion in sales, Wayfair is still well behind Amazon and Walmart, but ahead of Best Buy and Costco, according to the research firm Digital Commerce 360. The company sells a whole lot of furniture and then some, from kitchen islands and bathroom vanities to throw rugs, bunk beds, and hot tubs. Nearly all of its goods are delivered for free (even the 350-pound sectional sofas) and typically within a few days. Like its progenitors, Wayfair offers nearly unlimited choice, measures everything, and commits to making customers happy at all costs. That formula hatched in Conine’s bedroom has showered the cofounders with a collective net worth of more than $4 billion and vaulted their brainchild onto the Fortune 500 for the first time.

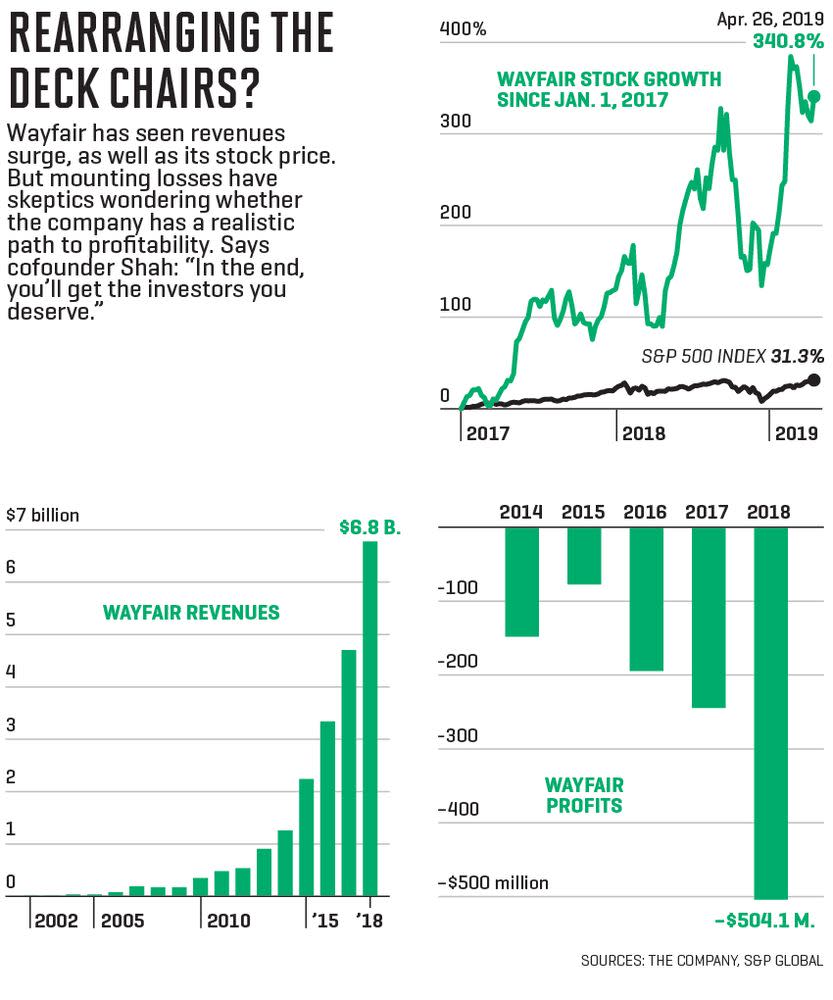

By almost any measure, Wayfair is killing it. Annual revenues have increased sixfold since the company’s 2014 IPO and are growing 40% annually, to $1.9 billion in the most recent quarter. The company employs well over 12,000 people in Boston; Berlin; Ireland; and various U.S. cities, with dozens more “Wayfairians” joining each week. The number of active customers, defined as having made a purchase in the past year, also jumped nearly 40% year over year, to 16.4 million, and the company is approaching household-name status. According to internal surveys, aided brand recognition (“Have you heard of Wayfair?”) is about 90%.

And yet. If you’ve had even a cursory interest in Wayfair, you know there’s a black mark on the company. It’s deep in the red. So much so that some believe Shah and Conine are on the road to ruin. Despite significant top-line growth, Wayfair lost more than half a billion last year, and losses nearly doubled in the most recent quarter over the first quarter of 2018. One prominent short, Andrew Left of Citron Research, refers to Wayfair as “the anti-Amazon.” A pair of academics published a widely quoted paper that asserts the company’s massive investments in infrastructure, ad spending, and European expansion are unsustainable. The skeptics contend that Wayfair has no path to profitability and all the revenue growth is only decreasing the likelihood of a best-possible outcome: acquisition by, say, Amazon.

Somehow the share price, while definitely volatile, has proved relatively resilient. So much so that those shorting the stock have lost a collective $1.07 billion over the past year, per a February report by S3 Analytics. The stock took a drubbing after the company’s first quarter earning announcement, then got swept up in a broad market selloff over tariffs, but was still up more than 50% year to date as Fortune went to press. It helps that Shah and Conine seem to have the trust of institutional buyers. Wayfair’s top 10 shareholders, including Fidelity, Janus, JPMorgan, Vanguard, and BlackRock, own 42 million shares, or roughly 70% of the float. Which means the smart money, at least for the time being, is buying and holding the Wayfair vision.

But there are two types of newcomers to the Fortune 500. Those, like Payless Cashways, which popped onto the list in 1995 only to disappear a few years later. Or those, like Amazon, which debut near the bottom (it crept in at No. 492 in 2002) and steadily ascend the ranks, changing, navigating, and evolving as they grow.

The question is, which kind of company is Wayfair?

It’s lunchtime in Wayfair’s Copley Square cafeteria in downtown Boston. Shah is holding forth on his vision for the company’s future over a chicken pesto Parmesan sandwich in the midst of a near monoculture of twentysomethings. He explains that the total addressable market for home goods—including furniture and just about everything else for your home—in the U.S. and Europe represents an $800 billion opportunity. Wayfair is currently capturing about 1%. He wants the rest.

Asked how he intends to make that happen, he launches a narrative stream, each word racing to stay ahead of the one behind it. Sentences arrange into fully formed, highly articulate paragraphs. It’s clear he’s done this before. Maybe a thousand times. But the repetition hasn’t dampened his excitement. Far from it. Here’s the gist.

The typical experience of buying home goods is awful. There are no real brands. Product discovery is difficult, and even when consumers know what they’re looking for, they don’t know how to ask for it. As with fashion, people buy home goods to reflect their taste and often need help. Instead, they get pushy salespeople on commission. Big items like sofas often require long lead times and are difficult to get home. Either you hire a U-Haul or incur expensive delivery charges. It’s also a lousy business for suppliers because even the largest brick-and-mortar retailers have only so much room. It’s tough for retailers, too, because customers often disappear for years at a time. And financially, it’s brutal for online retailers because customers can’t touch the product, which creates a barrier to buying (“friction,” as they call it) while also increasing the chance of pricey returns.

Wayfair is fixing this morass with a virtually unlimited selection for every taste and budget—more than 14 million products from 11,000 suppliers. It employs more than 2,300 engineers and data scientists who drive loyalty and attempt to reduce friction through extreme personalization. An additional 3,000 customer service reps foster satisfaction and loyalty. The company has more than 12 million square feet of warehouse space, including a dozen North American and European fulfillment centers, from which it hand-delivers bulky packages, many within two days. Shah says this growing network is the key to implementing next-day and same-day delivery. Wayfair is also creating new technologies to improve a consumer’s ability to design, stage, and even virtually feel furniture before buying it. And it’s dropping $1 billion in advertising a year because, all together now, the millennials are coming!

“Their propensity to buy online is four or five times our core customer today. Now roll this story forward a decade, two decades, when the whole population of buyers becomes folks who grew up with a phone connected to the Internet. They’re married with a house and kids,” Shah says. “Millennials are just starting to age into that spot where they’ll stop spending so much on travel and beer, and start spending the next 25 years investing in their homes.”

Shah and Conine are hardly the first entrepreneurs with a hunger to dominate home goods. The category is littered with the dead and dying, from Levitz and Sears (see our feature in this issue) to Bed, Bath & Beyond. And going Internet-only is no insulation. One Kings Lane raised $100 million in funding only to sell for $30 million. And it was lucky to find an exit. The much-hyped millennial-focused Dot & Bo merely died on the vine. Wayfair is likely past the point of suffering such a fate. But it could yet be crushed by Amazon. Digital Commerce 360 pegged Amazon’s 2017 home goods sales at $12 billion—up 50% from the prior year. If Jeff Bezos and company once seemed ambivalent about a category often considered to be too expensive or too difficult to fulfill, that’s clearly no longer true.

Another similarity to the Seattle giant: Investors are clamoring for information on Wayfair’s path to profitability. In my conversations with Shah, he seems unconcerned with outside criticism. He asserts to me, and subsequently to investors during the May earnings call, that the company’s U.S. operations have been “adjusted Ebitda profitable for seven of the last 10 quarters.” But really, he seems to view the very subject as a distraction. “The best piece of advice I got in the early days was, when it comes to investors, don’t try to sell them anything. Just tell them what you’re planning to do. If they find it interesting, maybe they’ll buy the stock,” he says. “In the end, you’ll get the investors you deserve.”

Massachusetts in mid-April, when spring is a state of mind: “It’s currently 48 degrees and raining in Boston,” Siri says. “Today you should expect more of the same.” Conine is undeterred. Whereas Shah projects a bookish intellectual prone to oxford shirts and pushing up the bridge of his glasses with the middle of his index finger, Conine is a competitive mountain biker who’d just plain rather be outside. His hair is perpetually tousled, and he favors weekend casual: nylon pants, hiking boots, a co-branded Patagonia vest. This morning he’s extended an invitation to go paddleboarding on the famously dirty water of the Charles River.

We meet at a launch point a couple blocks from his home just after dawn and joke about the over/under on how long before someone falls in. As it turns out, about 10 minutes. “I wouldn’t worry too much,” Conine says dryly as I pull myself back on the board. “I think it’s relatively clean this time of year.”

We continue on our knees alongside the bucolic Back Bay neighborhood while he narrates Wayfair’s early days. He recalls repeated visits to the annual furniture conference in High Point, N.C., where he and Shah would walk the show floor trying to connect with manufacturers and distributors to learn the business and to understand their frustrations.

He tells me about one of the decisions the partners made in the early years when it came to hiring. The company would hire for analytical strength, the ability to think strategically, and mental dexterity rather than for experience—including at the highest levels of management. During two days in Boston, I interview, among others, the CTO, who has an MBA in finance; a director of data science, who has a Ph.D. in physics; and the head of global talent, another MBA whose background includes private equity at Bain and consulting with McKinsey but excludes personnel management experience. (The place is crawling with ex-consultants.)

When such an approach goes wrong, employees gripe on the job boards about their clueless managers. But the rationale was that there’s no true precedent for the Wayfair way, so the best strategy is to hire for cultural fit, educate new hires, and trust they’ll catch up. To this day, Conine tries to explain this strategy to the new hires at every weekly orientation when he’s in town.

We dry off and head back to Copley Square, where Shah picks up the thread about some of the key early inflection points. By 2008, he says, drawing a timeline on a whiteboard, those 250-odd microsites had $250 million in sales. “At that point, we noticed one of the big weaknesses in our model was that customers were very happy, but the repeat purchase rate was something like 10% or 20%,” he says. “For the next two years, we focused on driving repeat orders.”

They rolled everything into an umbrella company called CSN Stores, designed a common header to connect everything visually, and started an email marketing program to drive traffic to sister sites. Repeat rates doubled—then plateaued. It was time to build a brand that customers could easily understand and develop trust with across product categories. (There’s no real origin story with the Wayfair name. They paid a branding firm a bunch of money.) In 2011 they unveiled Wayfair.com and raised their first round of capital with an eye toward driving awareness.

Wayfair still puts a tremendous amount of effort and money into building its brands, which now include Wayfair.com, AllModern, Birch Lane, Joss & Main, and Perigold. But it’s not a typical approach to marketing. Executives repeatedly tout the company’s “build your own” culture, and marketing is no exception. Rather than outsource creation and media placement to agencies, it employs internal teams to create and handle its ubiquitous TV commercials, email campaigns, postcards, catalogs, magazine ads, Instagram influencer posts, and collateral around various promotions like Way Day, Wayfair’s version of Prime Day. A/B testing is the norm. Data scientists crawl over every bit of copy, color palette, and product placement. And there’s no set budget. Wayfair expects to spend close to $1 billion on marketing this year—but that could go up if the returns justify increased spending. “We’re taking a discipline that is traditionally quite subjective and applying a lot of math and science,” says VP of marketing Bob Sherwin, who oversees the media-buying, measurement, and ad-tech teams as well as 130 engineers and data scientists. It comes as little surprise that he has no marketing experience. He’s ex-McKinsey.

Wayfair’s marketing team has created a proprietary bidding algorithm for paid search and a machine-learning program to predict the value of approximately 20 million keywords. They built a dynamic retargeting platform to analyze browsing history and advise how Wayfair ads should follow you across the Internet, and it’s being repurposed to improve product recommendations. “One of the things we’ve learned is that leveraging information about you is always a good thing. We see improvement every time we do it,” Sherwin says. “But our ML platform will also determine the ideal set of products to show any new visitor. Historically, that kind of thing was done manually, based on intuition, but that wasn’t scalable.”

When it comes to media buying, the team uses custom algorithms to scour for “arbitrage opportunities.” For example, they noticed that rates drop every January, when media-buying agencies—they surmised—are in contract negotiations with clients, so that’s when they swoop in to get more value. “We do media buying like a portfolio manager makes stock-buying decisions,” he says. “When the market is behaving irrationally, we don’t chase the bids.”

Daniel McCarthy isn’t sold on any of this. He’s an assistant professor of marketing at Emory University and a coauthor of a widely cited paper, “Customer-Based Corporate Valuation for Publicly Traded Non-Contractual Firms.” It explores various methods for gauging customer long-term value and scrutinizes customer acquisition costs (CAC) of a few companies, including Wayfair. The thesis is complex, but the takeaway is bearish. In short, he says Wayfair spends way too much and that things are only getting worse. “CAC rose to new highs this quarter, about $88 to bring in every new customer,” he says. “They’ve been making these investments for four years, and their margins have actually been deteriorating. The last quarter was the worst in their history.” McCarthy also questions Wayfair’s ability to replicate its U.S. model in Europe.

From Sherwin to Shah, the Wayfair response is to scoff at the simplicity of CAC metrics. “The calculation assumes all of our marketing dollars go against new customers, but more of our ad spend is going to existing customers that are loyal to us,” Sherwin says. What’s more, customer behavior doesn’t track neatly to quarterly earnings. While home-furnishings purchases can be highly sporadic, he points out that the average customer made 1.85 purchases over the past 12 months.

The plan is to bring customers back more regularly in the future. One of the company’s most interesting efforts is called Wayfair Next. Think of it as an R&D lab focused on replicating or even improving upon the terrestrial home goods retail experience in a digital forum.

The lab has been working with virtual reality and augmented reality for a few years, and during my visit, the head of Wayfair Next, Shrenik Sadalgi, lets me try an app on the Magic Leap AR platform that makes it possible to pick and place virtual furniture into an actual room. A user can capture the pattern of her own rug or wallpaper and insert it digitally next to a Wayfair couch to see how they jell. They demo a custom-built scanner that enables them to create 3D-printed models of furniture and a haptics application that makes the screen of a tablet feel like the texture of fabric. These gizmos are medium-to-longer-term bets. They could turn out to be the equivalent of concept cars that never make it to market—or they may be the keys to building loyalty among millennials as they age into staging their living rooms.

Meanwhile, Wayfair’s work to improve fulfillment is already bearing fruit. According to the company, it has poured “hundreds of millions of dollars” into its CastleGate logistics unit to help deliver goods at the pace that consumers have become accustomed to, thanks to Amazon Prime. It’s a bet that by handling more of the fulfillment, Wayfair can benefit financially and increase customer satisfaction. Currently, “a meaningful and growing percentage” of the roughly 30 million packages it sells are delivered through the CastleGate network. The dollar value of small parcels shipped through CastleGate doubled in fourth quarter 2018 over the year prior. For large parcels, it rose to 14%, and the company expects that to increase.

To understand how CastleGate works, I visit one of the newest centers, an 874,000-square-foot facility alongside the highway just south of Dallas. Site director Jim DeSimone points out the various sizes and shapes of the shelves designed to accommodate irregular objects. Small parcels average three cubic feet and 30 pounds. Large items come in at 80 pounds and 22 cubic feet, on average. He introduces dozens of workers tasked with moving things around. They zoom by on electric forklifts and lift products onto a custom product mover that’s purpose-built to handle odd-size objects. The gleaming steel structure is 15 feet tall and features a 51-inch-wide conveyor belt that circles back on itself over the course of traveling a third of a mile. From a distance, the edifice might pass for a county fair roller coaster. The packages travel beneath a series of overhead sensors that scan bar codes and assign them to a particular truck. A mechanical arm pushes each package down one of the 15 lanes and into a shipping container.

This facility is where Wayfair’s rubber hits the road. If you’re picturing a highly automated scene with robots, that’s the wrong company. For all the technology and sophistication in Boston, fulfilling the promise to deliver oddly shaped and often heavy goods rests primarily on the shoulders of dozens of humans.

David Bergman, for one, appreciates the effort. The CEO of Butler Specialty Co., a furniture manufacturer that designs, engineers, and sells accent furniture like end tables, chests, consoles, and cabinets, has been running his Chicago business since buying it from his father and his father’s partner in 1998. Pre-Wayfair, his biggest sales problems stemmed from brick-and-mortar retailers. They had only so much display room and little ability to predict demand. He relied on sales reps to push for new orders and space on the retail floor. Wayfair has flipped the script with an unlimited ability to show long-tail goods and an unprecedented ability to measure and tweak demand. “They’ve built a partnership with vendors that pretty much never existed in home furnishings. It’s extremely unusual, and because of that, we buy into everything they’re selling—whether that’s CastleGate or promotions or whatever,” Bergman says. “Niraj has a clarity of vision that I’ve never seen in my career. He’s the kind of person you just want to follow.”

In our final meeting, the cofounders are seated in one of the many conference rooms dotting Wayfair’s open office. Conine is windblown from a bike ride. Shah is especially relaxed. “I thought you’d be sick of talking to us by now,” he says. The duo have made a 24-year journey from nearly broke students to running a Fortune 500 company. I ask if they’ve ever been to founders’ counseling. Conine laughs: “No! Though in the early days, I’d think, I can’t deal with this guy, and walk around the Charles to blow off steam. But we’d always work it out.”

As with any relationship, it’s difficult to know what happens in private, but outwardly, they still seem close. It’s not that they finish each other’s sentences. Shah’s rhetorical style doesn’t allow for it. But they intuit what the other is thinking. “We agree like 95% of the time,” Shah says. “When we disagree, well, that’s really interesting. You think, why? There must be something I’m not seeing.”

The cofounders and their families still own 32% of the company they created, as well as voting control. And while things may have started out a bit uneven with their bank accounts, it’s been 50/50 ever since. Equal partnership, Shah says, was one of the biggest decisions the duo ever made—because just as with a marriage, it’s crucial for a long-term business relationship to start on a stable footing. “Although I like to joke that I’m still running behind,” he says with a laugh. “I’ve always been better at spending my money.”

Jeffrey O’Brien (@jeffreyobrien) is cofounder of the Bay Area storytelling studio, StoryTK.

A version of this article appears in the June 2019 issue of Fortune with the headline “It’s All Clicking for Wayfair.”

More must-read stories from Fortune:

—The 2019 Fortune 500 list demonstrates the prize of size

—Fortune 500 CEO Survey: The results are in

—What the Fortune 500 would look like as a microbiome

—The Occidental-Anadarko merger reveals the crude truth about oil prices

—Why the giants among this year’s Fortune 500 should intimidate you

Catch up with Data Sheet, Fortune‘s daily digest on the business of tech.