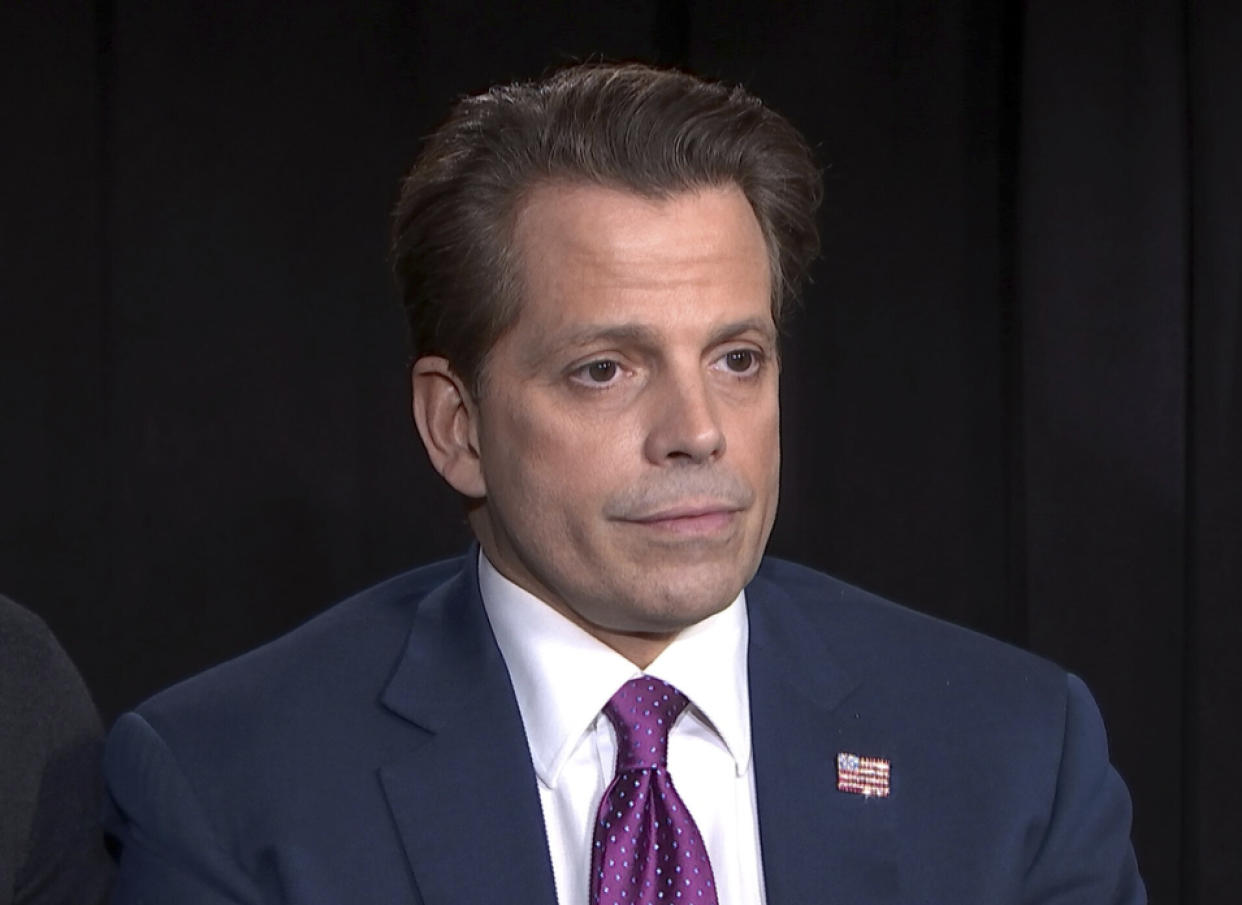

Anthony Scaramucci is ‘not in love’ with President Trump’s Fed criticism

Former White House communications director and current hedge fund manager Anthony Scaramucci doesn’t agree with President Trump’s putting pressure on the Federal Reserve, which has included multiple tweets over the past 6 months criticizing its policy decisions.

“Not in love with that,” Scaramucci told Yahoo Finance at his annual SALT conference in Las Vegas. “I think [Fed independence] is important for the market, because I think it sends a lot of signals to the international community about the strength and objectivity and the proper checks and balances we have in our system. Our market is the most liquid for a reason. People actually believe the rule of law and they believe in the independence of things like the Fed, and so I really hope that continues.”

Throughout the fourth quarter of 2018, Trump slammed the Fed on Twitter for raising interest rates too many times. He also criticized the Fed’s unwinding of its massive multi-trillion balance sheet.

During the first quarter of 2019, the Fed decided to hold off on additional rate hikes in 2019 and also announced plans to end its balance sheet runoff. These two factors sparked a dramatic stock market rebound.

Still, Trump’s Fed-related tweets have resurfaced, with calls for a rate cut.

Fed Chair Jerome Powell began his term in 2018.

—

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

Here’s what Uber’s IPO says about the broader stock market

Billionaire Ken Fisher: Why the stock market likely has more room to run

Warren Buffett: 'Something different' is happening in the economy right now

The market is starting to overreact to very specific economic data points

2019 may be the year of tariffs against European auto imports

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.