Amazon and Netflix can actually coexist: RBC

Amazon’s (AMZN) foray into an industry could be devastating news for its competitors. But that doesn't seem to be the case for Netflix (NFLX).

Seventy-three percent of Amazon Prime members are also Netflix subscribers, the latest survey by RBC Capital found. The percentage of Prime members on Netflix has inched up in recent years from 67% in 2016 to 70% in 2018, according to the survey. This is higher than non-Prime members who shop on Amazon — 43% of those people are subscribed to Netflix.

Despite recent price hikes, the $119 annual Prime membership and a Netflix subscription, which rose to $12.99 per month this year, are considered the top deals in the U.S., according to RBC analysts.

Netflix lists Amazon as one of its competitors in its filings, but emphasizes its focus is to serve customers better.

“Tech firms like Apple, Amazon and others are investing in premium content to enhance their distribution platforms,” the online entertainment giant said in its earnings report in October. “Amid these massive competitors on both sides, plus traditional media firms, our job is to make Netflix stand out so that when consumers have free time, they choose to spend it with our service.”

Consumers don’t mind paying for online content

The overlap of Prime and Netflix subscribers could make the case for giants like Disney (DIS) and AT&T (T) to get into the video streaming war, since there is still room for Americans to pay more for bundled video services.

“The average American right now is spending between $90 and $100 a month for multi-channel television,” Rich Greenfield, media analyst at BTIG, said on Yahoo Finance’s YFi AM. “Q2 is going to break new records for cord-cutting.”

“Certainly the most ambitious content is on these services. And so I think the reality is you're going to subscribe to a bunch of these,” Greenfield said, referring to streaming services including Netflix and Hulu, which on average cost less than $20 a month.

The RBC survey also found the majority of Prime members still expect to use Netflix “more” or “about the same.” Analysts say millennial Netflix subscribers are dependent on online entertainment and view Amazon Video as a great extra stop to binge-watch their favorite shows.

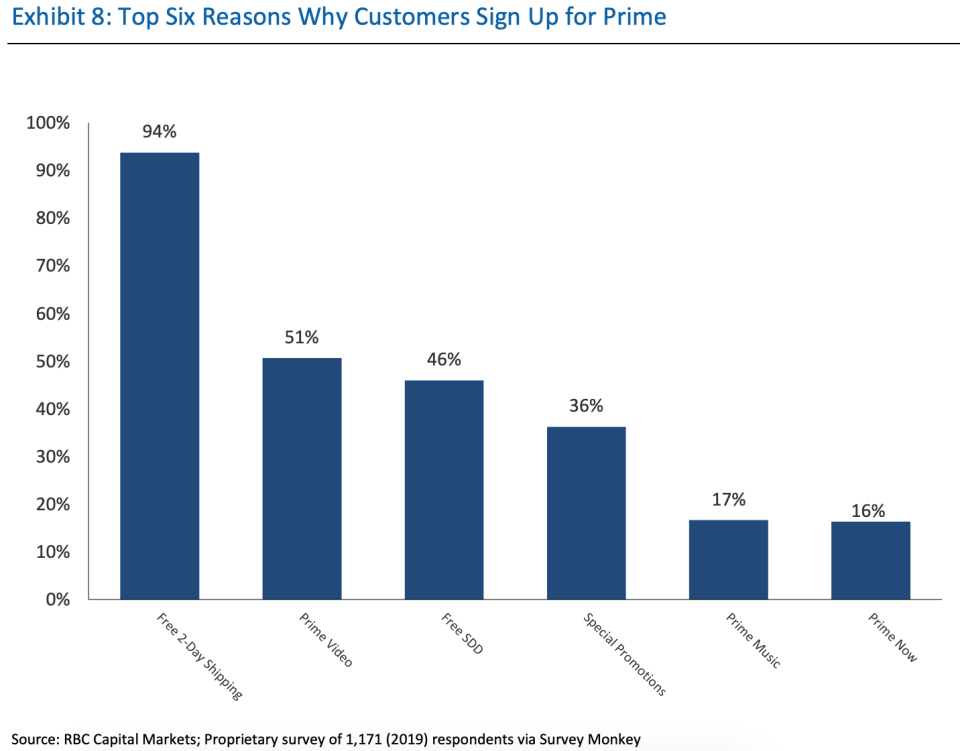

Another reason why Amazon Prime members may not mind paying for Netflix is that they merely see Prime Video as a nice add-on perk. According to the survey, the top reason why people pay for Amazon Prime membership is for the free two-day shipping. People also expressed increased interest in one-day shipping, which Amazon said they would invest $800 million in the second quarter to achieve.

RBC estimates there are over 75 million Amazon Prime members in the U.S. — that’s 59% of U.S. households — and Netflix has over 60 million U.S. subscribers.

Krystal Hu covers technology and China for Yahoo Finance. Follow her on Twitter.

Read more:

New bipartisan bills threaten Chinese IPOs and Chinese companies listed in the U.S.

Huawei is still winning 5G contracts around the world despite the U.S. ban

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn, YouTube, and reddit.