Is Alibaba Stock Attractive Heading Into Its Earnings This Week?

Alibaba (NYSE:BABA) has been beaten into the ground, with BABA stock falling 29% over the last three months and 22% so far in 2018. With the company’s quarterly results due out on Friday morning, what should investors do with Alibaba stock?

Under ordinary circumstances, buying BABA stock near the low end of its range ahead of its earnings would be a no-brainer. But high-momentum FANG names like Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX) have been smacked after their earnings, and even reasonably valued cloud names like Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG) have struggled after reporting their quarterly results.

Meanwhile, Chinese equities like JD.com (NASDAQ:JD), BABA and others have been under tremendous pressure. The lack of momentum in tech, the cloud, China and elsewhere makes BABA stock untouchable for many investors, if its earnings are on deck or not.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Valuing BABA Stock

Has BABA stock been unfairly punished? Some could certainly make that argument. Don’t forget that Alibaba stock is the top dog of China’s massive e-commerce market. As a result, its growth has been stellar. For example, analysts expect its revenue to soar 58% year-over-year in 2018 and almost 40% in 2019.

On the earnings front, consensus forecasts call for just 12% growth this year and a big-time acceleration to 36% growth in 2019. While those estimates may not pan out, they paint quite the bullish picture for investors. That’s particularly true for those who are optimistic about China’s long-term outlook.

As for valuation, Alibaba stock trades at a rather reasonable — and some may actually say cheap — valuation of 25 times this year’s earnings. Moreover, BABA stock trades at just 18 times analysts’ 2019 consensus earnings estimate. Keep in mind that BABA is, for lack of a better comparison, the Amazon of China. Last quarter, its e-commerce sales surged 61% year-over-year, its cloud revenue jumped 93% and its media and entertainment revenue surged over 45%.

Alibaba’s founder and CEO, Jack Ma, may have announced that he’s stepping down, but it’s clear that this juggernaut is not struggling. Like I said, a long-term China bull would in all likelihood believe that BABA stock is attractive, particularly with China’s Singles’ Day coming up on Nov. 11. Each year, the forth-quarter sales of Chinese e-commerce players continue to significantly rise as more and more consumers celebrate Singles’ Day by buying gifts.

But Chinese stocks have fallen out of favor, and short-term traders may be disappointed with Alibaba, particularly in this market. However, long-term buyers might benefit from buying BABA stock.

Trading BABA Stock

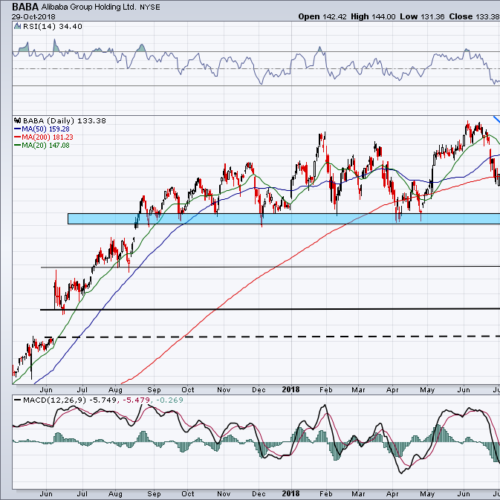

Alibaba stock has been ugly this year. The shares topped out at $210 in mid-June and have plummeted to $140 as of today. From top to bottom, that’s a decline of 33%.Will Alibaba’s earnings be enough to propel Alibaba stock higher?

I would love to see BABA stock slip a bit further. Specifically, I want a gap-fill down to the $126 level (depicted by the dashed line on the chart) into the company’s results. That would also keep it just inside the channel support depicted by the blue line. If Alibaba stock stays below those two levels, a bounce could ensue.

How big of a bounce are we talking about? We could get one that tops out near the $135 level, the gap-up level from June 2017. However, if investors like the results and they decide to ramp BABA stock ahead of Singles’ Day, we could get a run into the mid-$140s and perhaps even $150.

In the mid-$140s, BABA will reach its 20-day moving average. Near $150 it will hit the downtrend channel resistance, which is depicted by the blue line. Unless some seriously good news for Chinese stocks is announced, I can’t imagine BABA pushing through $150 in a straight line. If that does happen, though, look to see if the 50-day moving average of BABA stock acts as resistance.

If the $126 level fails to act as support, look to see if support comes into play near $115.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell was long GOOGL.

More From InvestorPlace

The post Is Alibaba Stock Attractive Heading Into Its Earnings This Week? appeared first on InvestorPlace.