5 Top Stock Trades for Monday, Including Netflix and Wells Fargo

Stocks got a solid boost on Friday, with the S&P 500 climbing about 55 basis points and the Dow Jones jumping over 90 basis points. Part of the rally in stocks came from banks, as the sector kicked off earnings.

Let’s look at a few more top stock trades going into next week:

Top Stock Trades for Tomorrow #1: Chevron (CVX)

Shares of Chevron (NYSE:CVX) are down about 5.4% to $119 in Friday trading after the company announced a $33 billion cash-and-stock takeover of Anadarko Petroleum (NASDAQ:APC).

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The move has APC moving higher, obviously, and CVX stock gapping below its 20-day and 50-day moving averages.

The next level of potential support comes at $118 and the 200-day moving average. However, I would be far more interested in a pullback down to the $108 to $110 area. From there, we’ll have to determine the breadth of the stock, but it could be a good place to start accumulating CVX and its mighty dividend.

Wells Fargo (WFC)

Wells Fargo (NYSE:WFC) joined JPMorgan (NYSE:JPM) and PNCFinancial (NYSE:PNC) in reporting earnings on Friday. Unlike its peers though, WFC stock is falling on its earnings report.

Downtrend resistance (blue line) and the 200-day moving average continue to plague WFC, while $47 to $48 support has now given way.

What should investors do? I have long preferred JPM or Bank of America (NYSE:BAC) and continue to feel that way now. WFC is trading poorly and investors now have to see if the $47 to $48 area, as well as the 20-day and 50-day moving averages will act as resistance.

A retest of the December lows seems extreme, but certainly isn’t out of the question.

PG&E (PCG)

This one still has life, apparently, with PG&E (NYSE:PCG) climbing 12% on Friday. More importantly, the move puts PCG over tough $20 resistance, while uptrend support, the 50-day and 10-day moving averages continue to ferry the stock higher.

I don’t particularly like PCG due to its volatility and more so at one point, its bankruptcy risk. Below $20 likely sends PCG back down to its 50-day moving average. Should $20 hold, a gap fill near $24 certainly isn’t out of the question.

Still, the name is too risky for me.

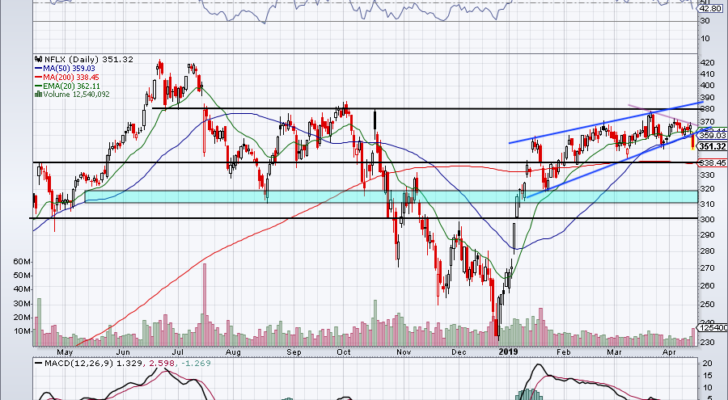

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is down about 4.7% to $350 on Friday, after Disney (NYSE:DIS) revealed more info regarding its Disney+ streaming platform.

To the dollar, we got exactly what we were looking for from Disney on its pullback going into this all-important event. Now the House of Mouse is ripping and NFLX is sagging.

Worth pointing out is that Netflix will report earnings next week, so there’s still potential for a big move. Earnings can either save the stock’s recent decline or accelerate it dramatically.

Look for $340 to hold up as support in the short-term, where the stock will also find its 200-day moving average. Below that and there are a few more levels where NFLX stock may find some reprieve, although below $300 would be cause for concern. While that would require a 16.6% decline from current levels, we’ve seen crazier things with this name.

On the upside, look to see that NFLX can clear prior short-term uptrend support and short-term downtrend resistance near $370. If it can, $380+ could be on the table.

For those who missed the move in Disney, it’s probably best to wait for a pullback. Shares were already up big going into the event and today’s 11% rally only adds to that condition.

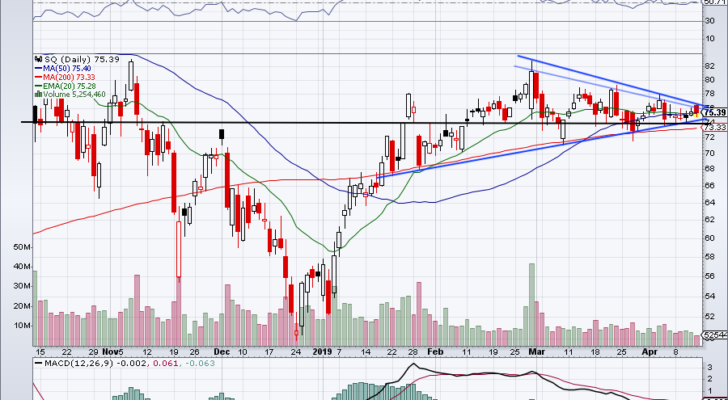

Square (SQ)

Square (NYSE:SQ) kind of reminds of that Spotify (NYSE:SPOT) trade we hit earlier this week as it continues to poke its head through $76 and pullback.

With its moving averages and uptrend support below, this creates a solid risk/reward setup in the name. A move over $76 could quickly get SQ to $78 or $79+ if it gains some momentum. Below $73 is concerning.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 5 Top Stock Trades for Monday, Including Netflix and Wells Fargo appeared first on InvestorPlace.