5 Top Stock Trades for Monday: TSLA, BIDU, IQ, DE, MU

Stocks did a good job bouncing off their morning lows, but how long can bulls keep that action up? The market would do a whole lot better if investors didn’t have to worry about a tweet from the president sending a ripple through Chinese and U.S. trade negotiations, but that’s the market we have right now. Let’s look at some top stock trades to get started on next week.

Top Stock Trades for Tomorrow #1: Baidu

Baidu (NASDAQ:BIDU) has one of the worst-looking charts out there among the names that I follow.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

It made a really elongated wedge from 2015 to 2017. I was hoping the bulls would be able to keep the stock above the backside of this prior resistance mark, but so far, no cigar. Maybe they can salvage it next week, but it’s looking pretty awful.

Below all of its major weekly moving averages (and daily moving averages for that matter), as well as any meaningful support level and this one is simply a no-touch for traders. Shares are down more than 15% after reporting earnings.

Until we see some hints of a reversal (maybe near $115 to $120) or until BIDU can reclaim $130 and $140, this one is stuck in no man’s land for the time being.

Top Stock Trades for Tomorrow #2: Tesla

We’ve been sounding the alarm bell on Tesla (NASDAQ:TSLA) since long-time range support near $245 to $250 gave way. It’s been stuck in this nasty downtrend and is making new 52-week lows on Friday.

Do bulls make a stand next week, perhaps near $210? Maybe. Or we might continue to see a flush. Wait for the move first, then react. Reclaiming channel support gives investors a level to shoot against while aiming for a retest of channel resistance. See how it trades on Monday and Tuesday.

Top Stock Trades for Tomorrow #3: iQiyi

Down more than 6% and it’s clear that the market doesn’t care about iQiyi’s (NASDAQ:IQ) strong user growth or revenue growth. Profits are missing and that’s worrying investors. It doesn’t help that IQ is a Chinese stock too.

The sign it was in trouble came once shares broke below $23, the gap-from level back in February. For those that needed an even more clear sign, the retest-and-fail earlier this month (purple arrow) showed that IQ’s time was up.

Below all of its major moving averages and with a trend pointed lower, IQ stock doesn’t look good. Maybe it bottoms near $18 to $18.50. If it breaks this mark, there could be a long way down. Keep in mind this stock was below $15 back in December. For anything sustainable to get going on the long side, it needs to get above its 20-day moving average.

Top Stock Trades for Tomorrow #4: Deere

Down 7.25% on earnings and it’s a tough day for Deere (NYSE:DE) too. Shares broke below range support at $155, as well as the 50-week moving average near $150. Now near $136, and DE may actually be setting up as a solid risk/reward long.

Shares have only closed below $135 on a weekly basis once since December 2017. Should this level hold next week, it could be a good spot to nibble. There have been a few “shoots” below this mark — some to the upper-$120s, some just into the $134s — but by and large $135 has held. A close below could take DE to $125.

Ideally, we see DE shoot below $135 before reversing higher and closing above this week’s lows. Then we’ll have a more measurable setup.

Top Stock Trades for Tomorrow #5: Micron

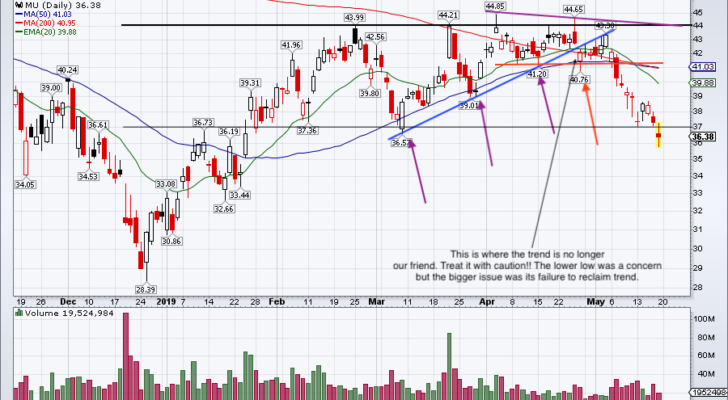

Last but not least, here’s a good lesson in Micron (NASDAQ:MU). Shares are down 3.3% on Friday and have been hammered these past few weeks. Remember at the beginning of the month, we flagged the warning signs here. In hindsight, I should have been even more cautious.

Shares were still OK despite that lower low (orange arrow) but then it notched a lower high as well. Once it broke $40.76 to the downside, that was the last-straw sign to bail. Now bouncing off $36, it’s been an ugly ride. If trapped bulls are lucky, they’ll get a bounce next week that they can unload into.

Otherwise, use this one as a lesson. When the trend bends, it’s no longer your friend.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 5 Top Stock Trades for Monday: TSLA, BIDU, IQ, DE, MU appeared first on InvestorPlace.