4 reasons it's a big deal Buffett is buying Berkshire stock

Berkshire Hathaway’s third quarter earnings report, released over the weekend, showed continued strength across the board, with book value and pre-tax operating earnings (excluding insurance and investment income) up 8% year to date.

But the most important piece of information in the report was the revelation that the greatest investor of all time, Warren Buffett, agrees with our view that the stock offers one of the most attractive risk-reward equations in the market.

We know this because of a major new development: during the quarter, Buffett bought back $928 million worth of his stock at $311,000 per A share ($207 per B share).

For most companies, this wouldn’t be news, as the majority of large companies buy back their stock, nor would it indicate a buying opportunity, as various studies show that companies, collectively, do exactly the wrong thing: buy heavily when stocks are most expensive and very little when they’re cheapest.

But when Buffett buys his own stock, it’s a big deal for a number of reasons. First, he’s Warren Buffett. In light of his unparalleled track record, investors rightly pay attention when he says a stock is cheap — and puts his money where is mouth is.

Second, we can be certain that he’s not buying back his stock to “show support” for it, juice earnings per share, or any of the many other self-serving, uneconomic reasons that CEOs like to buy back their stock.

No, there’s only one reason Buffett would buy back his stock: because he not only believes it’s trading well below his estimate of intrinsic value, but also represents one of the most compelling opportunities among all large-cap stocks in the world. After all, rather than buying his own stock last quarter, he could have added to any of his existing positions or established a new stake in any other large-cap stock.

Third, the buyback was noteworthy because it’s rare: he’s only done it once before in his nearly half-century of running Berkshire ($1.3 billion in the 2011-12 period, mostly at $131,000/share, equal to a bit less than 1.2x book value at the time). Those who bought the stock then did very well in the subsequent two years, as the stock rose more than 70%, handily beating the S&P 500, as this chart shows:

Lastly, it’s especially noteworthy because of the price Buffett was willing to pay: for years, Berkshire’s buyback plan capped the repurchase price at no more than 1.2x book value. In July, however, the company announced a new policy (for which we’d been advocating for years): “share repurchases can be made at any time that both Warren Buffett, Berkshire’s Chairman and CEO, and Charlie Munger, a Berkshire Vice Chairman, believe that the repurchase price is below Berkshire’s intrinsic value, conservatively determined.”

At the time of this announcement, we didn’t think it was particularly important because the stock was (and still is) trading around 1.4x book value, so we viewed it as something that would only be actionable if there were a big selloff in the stock.

Thus, we were stunned when Buffett disclosed in an interview on August 30 that “we bought back a little” — and were even more delighted when the 10Q revealed that he’d been buying back in size: $928 million in a single quarter. That’s not huge in the context of a company with a $540 billion market cap, but it’s not chicken feed either.

More importantly, it shows that: a) Buffett and Munger are highly confident that the stock is worth considerably more than today’s levels; and b) have put a soft floor on the stock around $311,000 per A share, which shifts the risk-reward equation very favorably.

It’s not a surprise to us, therefore, that the stock was up more than 5% on Monday to above $324,000 on this news.

Why the stock is attractive

Even with this jump, we still think the stock is attractive. Berkshire owns an extraordinary collection of businesses, both partially and wholly owned. It owns a concentrated portfolio of blue-chip stocks, the largest of which are (in descending order): Apple, Wells Fargo, Coca-Cola, Bank of America, Kraft Heinz and American Express.

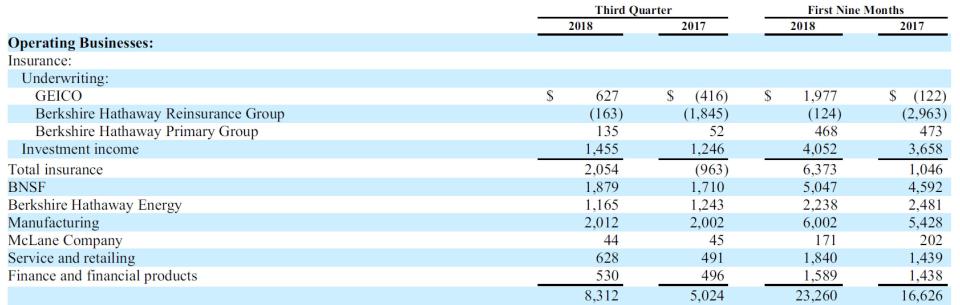

Berkshire’s wholly owned companies operate in the insurance, utility, railroad, manufacturing, retail and service industries and generate huge and rapidly growing pre-tax operating earnings, as this table shows:

Buffett invests the nearly $2 billion of free cash flow that pours into Omaha every month to buy new businesses and securities, a beautiful virtuous cycle that results in Berkshire’s value compounding at a healthy low-double-digit rate.

Berkshire is firing on all cylinders and Buffett is showing no signs of slowing down, yet Wall Street still doesn’t fully appreciate this business, in part because Buffett doesn’t talk to analysts, host conference calls or play the earnings guidance game.

We have followed the company for decades and conservatively value the stock at around $363,000 per A share ($242 per B share), 12% above today’s levels. We arrive at this figure by assigning an 11x multiple to the pre-tax earnings of the operating businesses (approximately $151,000 per share) and adding the investments per share (cash, bonds and stocks of approximately $212,000 per share).

While 12% upside may not sound exciting, Buffett’s willingness to buy the stock around these levels puts a soft floor in the stock. And, we’re more confident than ever that our estimate of intrinsic value is conservative.

We expect Berkshire to continue growing at well above market rates and any material acquisitions would, of course, further accelerate growth.

In Buffett’s long career, he’s rarely been wrong when he’s made a major stock purchase, and we see no reason why this case would be any different, especially since it’s his own company, about which he has perfect information.

Whitney Tilson founded and for nearly two decades managed hedge fund Kase Capital. He is now teaching the next generation of investors via his new business, Kase Learning.