3 Days Left Before UP Global Sourcing Holdings plc (LON:UPGS) Will Start Trading Ex-Dividend, Should You Buy?

Important news for shareholders and potential investors in UP Global Sourcing Holdings plc (LSE:UPGS): The dividend payment of £0.03 per share will be distributed into shareholder on 30 January 2018, and the stock will begin trading ex-dividend at an earlier date, 04 January 2018. What does this mean for current shareholders and potential investors? Below, I will explain how holding UP Global Sourcing Holdings can impact your portfolio income stream, by analysing the stock’s most recent financial data and dividend attributes. See our latest analysis for UP Global Sourcing Holdings

5 questions to ask before buying a dividend stock

When assessing a stock as a potential addition to my dividend Portfolio, I look at these five areas:

Is it paying an annual yield above 75% of dividend payers?

Does it consistently pay out dividends without missing a payment of significantly cutting payout?

Has the amount of dividend per share grown over the past?

Is its earnings sufficient to payout dividend at the current rate?

Will it be able to continue to payout at the current rate in the future?

How does UP Global Sourcing Holdings fare?

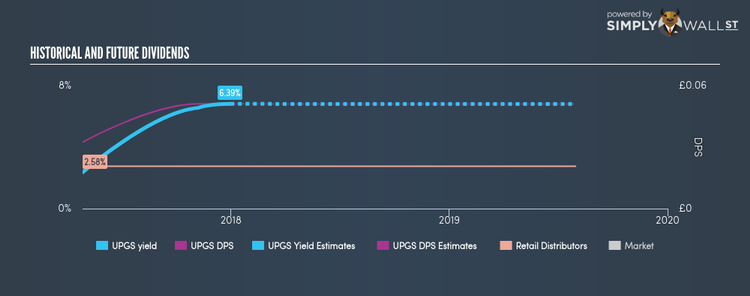

UP Global Sourcing Holdings has a payout ratio of 70.88%, meaning the dividend is sufficiently covered by earnings. In the near future, analysts are predicting lower payout ratio of 57.30%, leading to a dividend yield of 6.38%. However, EPS should increase to £0.07, meaning that the lower payout ratio does not necessarily implicate a lower dividend payment. If there is one thing that you want to be reliable in your life, it’s dividend stocks and their constant income stream. The reality is that it is too early to consider UP Global Sourcing Holdings as a dividend investment. Last year was the company’s first dividend payment, so it is certainly early days. The standard practice for reliable payers is to look for 10 or so years of track record. In terms of its peers, UP Global Sourcing Holdings produces a yield of 6.39%, which is high for retail distributors stocks.

What this means for you:

Are you a shareholder? Investors of UP Global Sourcing Holdings can continue to expect strong dividends from the stock moving forward. With its favorable dividend characteristics, UP Global Sourcing Holdings is one worth keeping around in your income portfolio. But, depending on your current holdings, it may be valuable exploring other income stocks to increase diversification, or even look at high-growth stocks to complement your steady income stocks. I recommend continuing your research by exploring my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? Considering the dividend attributes we analyzed above, UP Global Sourcing Holdings is definitely worth keeping an eye on for someone looking to build a dedicated income portfolio. As always, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. No matter how much of a cash cow UP Global Sourcing Holdings is, it is not worth an infinite price. Is UP Global Sourcing Holdings still a bargain? Take a look at our latest free analysis to find out!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.