What a higher education tech company tells us about a tightening labor market

Amid a tight labor market, universities are getting choosier about who they are admitting to their graduate programs. And the trend sent shares of one education technology provider down over 25% on Wednesday.

Lanham, Maryland-based 2U (TWOU) is an education technology provider that partners with schools to offer online graduate degree and short course programs. After the closing bell on Tuesday, the company said it would be lowering its expectations for year-over-year revenue growth from 31% to about 25%.

2U CEO Christopher Paucek said on the earnings call May 8 that as schools grow in size, admissions offices are tightening their standards on who gets in.

“Our oldest programs, while still large, are choosing additional selectivity over incremental scale and we respect that,” Paucek said.

Shares of 2U tumbled 25.30% to $44.77 by market close on May 8 as Credit Suisse analyst Brad Zelnick downgraded the company due to the “longer-term issue” of schools balancing their on-campus classes with online offerings through 2U. Credit Suisse lowered its target price on the stock from $85 to $55.

With a labor market that is leaving few actively-searching workers on the sidelines, universities may not be finding suitable students from the pool of applicants. Consequently, schools are tightening their admissions standards to ensure their admitted students are qualified for the programs.

Maintaining the value of a grad degree

Graduate programs are becoming more popular with services like 2U and other tech companies making classes available online.

But schools deciding to tighten on admissions standards suggests that programs are worried about diluting the value of their advanced degrees, raising the larger question of whether or not higher education is properly serving the needs of the tightening labor market.

Only 3.6% of the labor force was unemployed as of April — the lowest level since December 1969.

In theory, a tight labor market should favor workers as employers bid up wages and benefits to fill job openings. Depending on the skill sets needed for available jobs, a tight labor market could convince some laborers to forego higher education, learn a trade, and directly join the workforce.

That trend has already taken form in some corners of the country. The Federal Reserve’s March report of economic conditions noted that in Louisville, Kentucky, college enrollment declined as workers actively decided they didn’t need higher education.

Data shows that fewer young Americans are receiving advanced degrees like a master’s, professional, or doctoral degree — the demographic that 2U is targeting with its online courses.

Data from the Bureau of Labor Statistics shows that between January and October 2017, 442,000 people between the age of 20 and 29 earned an advanced degree. During the same period in 2018, only 352,000 people in the same age range earned an advanced degree — a 20% decline.

Although data is thin on how many graduate school applicants there were in 2017 and 2018, 2U observed that there’s still “tremendous amount of activity top funnel,” referring to the pipeline of prospective students actually interested in graduate programs. That observation, combined with the aggregate figures showing lower numbers of degrees awarded, shows how much schools may be tightening their admissions standards.

As schools get choosier, graduates with advanced degrees are having more success finding jobs. The unemployment rate for recent advanced degree recipients was 11.9% in 2017, and decreased to 10.4% in 2018.

Not everyone benefitting from tight labor market

At all education levels, there’s a debate that the tight labor market is ignoring the broader trend of a smaller available workforce. Although the headline unemployment rate is at remarkable lows, that figure excludes workers who have given up on finding a job.

The labor force participation rate, which measures all employed workers as a percentage of the total working age population, has declined considerably over the last 10 years. In April 2009, in the midst of the financial crisis, 65.7% of Americans were part of the workforce. That number has slipped to 62.8% as of April 2019.

Pamela Loprest, a senior fellow and labor economist at the Urban Institute, told Yahoo Finance that the educational system could do a better job at giving the available workforce the training it needs to fill available jobs. There’s also the question of whether or not a bachelor’s degree is accessible to lower-income Americans who would need higher education to raise their income levels.

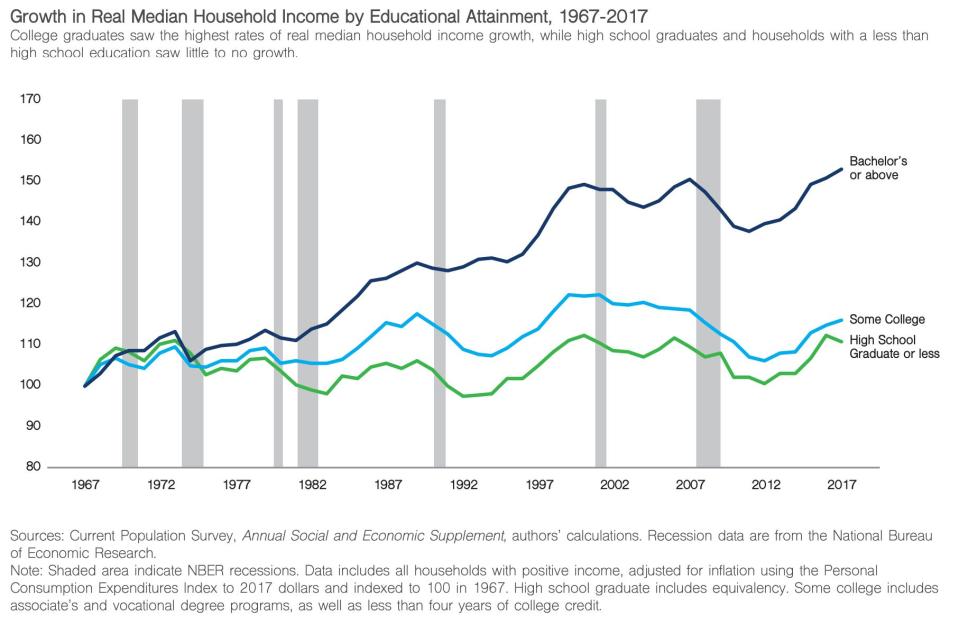

Data pulled by the Federal Reserve Bank of Chicago shows that high school graduates and households with less than a high school education have seen little to no growth over the last 50 years.

“When you have many people who are working at jobs that are very low wage in a country that’s very rich and with some of the best higher education institutions in the world, you have to think something’s not quite adding up,” Loprest said.

Loprest added that technological advances, such as online learning, have the potential to make job training programs available to the masses.

No back row

2U’s mantra of “no back row” pitches its technology as a way of making a graduate degree more accessible and interactive to the masses. In April, the company inked a $750 million deal to acquire Trilogy Education, which offers “boot camps” to prepare adult learners for jobs in coding, data analytics, and other digital-focused fields.

But as a publicly-traded company, it faces questions on whether or not its core portfolio of graduate programs have hit a saturation point in this tight labor market. Spruce Point Capital Management has had a short position on the stock since July 2018, claiming that four of the top seven university programs at 2U have peaked or seen enrollment declines.

“We’ve said all along that TWOU’s growth expectations were too high, its valuation multiple is undeserved, and that competition would pressure its ability to turn a profit,” Spruce Point founder and chief investment officer Ben Axler wrote in an email to Yahoo Finance. “It appears that investors are growing impatient with the story.”

There’s also the lingering question of the reputational issues with its partners that were implicated in the college admissions scandal, in which over 30 parents were accused of paying more than $25 million to cheat their kids into being admitted to top U.S. colleges. Four undergraduate programs involved in the scheme also have 2U graduate programs: Northwestern University, Yale University, University of Southern California, and University of California at Los Angeles.

On the earnings call, Paucek said it’s “entirely possible” that the business sees an impact, but has yet to see any data showing an effect.

For the time being, 2U says it will roll with the punches as the story on graduate enrollment unfolds.

“This is driven by a few challenges in the grad segment, some that are in our control and some that aren't,” Paucek said.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

NY Fed: Yield curve shows 27% chance of recession in the next year

Economist John Taylor: Interest rates should go to around 3%

Powell on the economy: 'We don't see any evidence at all of overheating'

Fed holds rate steady, says inflation is 'running below' its target

Bank CEOs quiet on M&A ambitions as expectations for consolidation build

Congress may have accidentally freed nearly all banks from the Volcker Rule