2017 is the first year that non-tech companies lead tech investing

Investments in private technology startups by companies outside the tech industry are on pace to surpass those of tech companies for the first time ever.

Fifty-one percent of Fortune 500 investments into private tech startups have come from non-tech companies in 2017 year-to-date, up from 29% in 2014, according to a new report from venture capital database CB Insights.

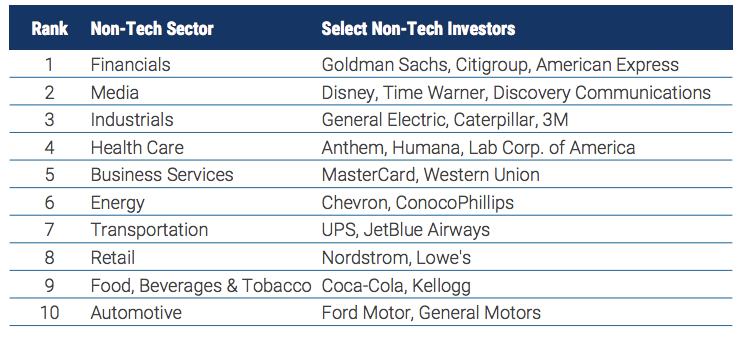

Between 2013 and 2016, private tech investments by non-tech Fortune 500 corporations grew 149%. Non-tech companies encompass industries like financial services, energy, retail, food, transportation, industrials, media and healthcare. Investments are defined as equity financings into private companies.

Financials leading the push into tech

It turns out that Goldman Sachs (GS) is the most active non-tech investor.

“We are a technology firm, we’re a platform… and it doesn’t stay still,” Goldman Sachs CEO Lloyd Blankfein has reiterated time and time again. Nearly 30% of all Goldman employees are engineers and programmers.

Of the non-tech sectors, financials represent one-third of the companies investing in tech in 2016. Companies in financials, media and industrials combined were responsible for 76% of tech investments by non-tech Fortune 500 companies last year.

Banks are making investments both for strategic purposes (like the venture arms of Citigroup and American Express) as well as for financial reasons — Goldman has invested in startups like Uber and Ring, according to the report.

Doubling down on the unicorn club

In fact, non-tech corporations of the Fortune 500 have invested in one-fourth of all unicorns, or those startups valued at $1 billion or more.

Take, for example, Instacart, which has raised funding from Whole Foods (WFM), while Vice Media, which has raised money from Disney (DIS) and News Corp (NWSA).

Non-tech companies have invested in hot startups like Pinterest, Flipkart, Stripe, Lyft, Magic Leap and DocuSign.

Airbnb, SpaceX, Palantir and WeWork are notable absences from the list of unicorns with investments from Fortune 500 non-tech companies.

Financials, in particular, dominate the list of non-tech corporations invested in unicorns.

Goldman is an investor in Uber, Spotify and Oscar Health. BlackRock (BLK) is an investor in Didi Chuxing and Dropbox as well as Uber. Morgan Stanley (MS) has placed bets on Dropbox, Flipkart and Domo.

Bullish on artificial intelligence

Companies outside of the tech sector are increasingly active investors in AI startups, likely because they want to incorporate machine learning into their business models.

Between 2013 and 2016, AI investments by non-tech firms increased nearly four times and are on pace to rise for a sixth-straight year, according to CB Insights. Active investors include Citi (C) , General Electric (GE), Lockheed Martin (LMT) and the United Services Automobile Association (USAA).

Non-tech companies becoming more acquisitive

Across all tech acquisitions, non-tech companies became 30% more acquisitive between 2015 and 2016 and are on pace to make over 75 acquisitions this year, according to the report.

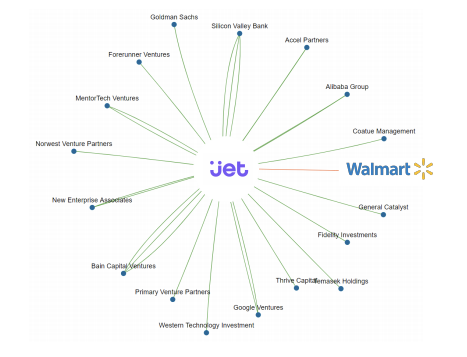

Of the largest VC-backed tech acquisitions by non-tech companies since 2012, seven different verticals (e.g. auto, industrials, media) are represented. Walmart (WMT) is a key example, acquiring both Jet.com and Bonobos this year.

“Walmart.com will grow faster, the seamless shopping experience we’re pursuing will happen quicker, and we’ll enable the Jet brand to be even more successful in a shorter period of time. Our customers will win. It’s another jolt of entrepreneurial spirit being injected into Walmart,” Walmart CEO Doug McMillon said regarding the acquisition .

Nordstrom (JWN) acquired Trunk Club and Disney purchased Maker Studios in 2014, while General Motors (GM) acquired Cruise Automation last year.

It shouldn’t come as a surprise that legacy brands across every industry are recognizing the need to augment their existing businesses with tech-driven offerings to keep up with their consumers.

Melody Hahm is a writer at Yahoo Finance, covering entrepreneurship, technology and real estate. Follow her on Twitter @melodyhahm.

Read more: