These 2 states are considering some of America's lowest cannabis taxes

As voters weigh in on recreational cannabis initiatives in Michigan and North Dakota on Tuesday, they should take note that the two states would have some of America’s lowest cannabis taxes.

The relatively low tax levels could prove a tough sell for voters on the fence who would like to see higher revenues flow into their states. Michigan’s Hemp Legalization Initiative, Proposal 1, would legalize recreational use and impose a 6% sales tax, as well as a 10% excise tax funding local governments, education, and infrastructure.

North Dakota’s Measure 3, which would also legalize recreational weed, contains no provision for marijuana-specific taxes. But the state’s tax commissioner has indicated that marijuana products and paraphernalia would be taxed at 5%, along with possible local taxes.

That’s low compared to Washington state, whose taxes for recreational marijuana can reach around 46% including its excise tax and state and local retail taxes. Meanwhile, California’s recreational marijuana taxes can reach around 45%, according to Beau Whitney, senior economist for New Frontier Data, a nonpartisan research firm that provides data to cannabis industry stakeholders.

Dropping cannabis taxes

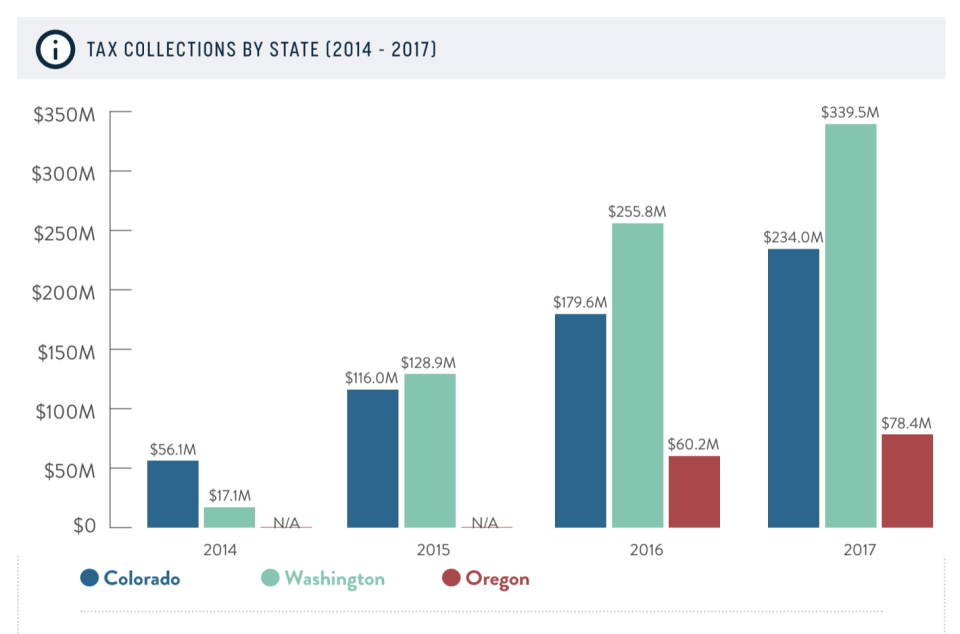

Cannabis taxes have been dropping since the first states authorized recreational use, according to Joseph Henchman, executive vice president for The Tax Foundation, a nonpartisan think tank.

“It’s a trend we’ve been seeing,” he said. “The first states to legalize — Colorado and Washington — had very high excise taxes, in the 30% range, and that ended up being too high to drive out the black market.”

In order to collect any marijuana taxes at all, states with legalized cannabis need to make the legal market more attractive than the illicit market. “Tax and tax policy play an extremely important role in driving the consumer in the conversion from the illicit market to the consumer market,” said Whitney, the New Frontier Data economist.

Whitney explains that pricing differentials between the cost of buying legal versus illegal marijuana in states like California are still driving consumers to travel great distances to purchase cannabis products. California levies a 15% cannabis tax at the state level, and with added local taxes, prices itself out of the market for some consumers with an aggregate level ranging around 40% to 45%.

“California, at the aggregate level, is at the 40 to 45% tax range when all is said and done,” Whitney said.

Washington state has another of the country’s top cannabis tax tiers, imposing a 37% excise tax, plus another 9%, on average, for state and local retail taxes. The aggregate level typically reaches around 46%.

North Dakota bill’s vagueness might make it hard to pass

Critics of North Dakota’s bill say more should have been done to lay out tax, regulatory and enforcement details before voters were asked to decide on legalization. The state also struggled with estimating legalization costs. Its Office of Management and Budget issued a September 2018 report with nearly half of departments concluding that legalization costs were “unknown.”

Haymond said the scant amount of detail in North Dakota’s bill could dissuade some voters, though he thinks prospects in the red state remain strong given the bill’s support from both sides of the aisle.

“As it stands, the bill is quite broad,” he said, explaining that conservative and libertarian voters could prefer the lack of a mandated tax structure.

“It would be both the most liberal and the most conservative bill on marijuana that voters have seen.”

Still, Haymond says, in North Dakota, “It’s a dogfight. In my heart of hearts, this is a toss-up.”

The bill in Michigan isn’t a sure thing, either. Barton Morris, Principal Attorney for Cannabis Legal Group, says that while he expects Michigan voters to green light recreational use, high turnout numbers will be key.

“I think there’s a chance it might not pass,” Morris said. “The opposition has spent a lot of money to influence the vote.”

‘A lot of these businesses are struggling’

As more states legalize marijuana for medicinal and recreational use they’ll also be competing for cannabis businesses, where tax levels will play an increasingly important role.

“A lot of these businesses are actually struggling because they pay so much in taxes,” Whitney said.

Whitney points out that marijuana businesses are treated differently in the eyes of the federal government because they’re offered fewer deductions while still having to pay income tax. So if the federal government does legalize, states that have already established a legalized revenue stream would need to adjust. According to Whitney, full federal legalization would translate to approximately 630,000 new jobs by 2025, likely requiring marijuana businesses to pay payroll taxes, in addition to any state level taxes they’re already paying.

In the end, taxpayers want to know that the social benefits outweigh the social, administrative and enforcement costs. “We talk to stakeholders in each state and around the world,” Whitney said. “Some are trying to calculate the costs and if there is some sort of dividend with legalization.”

For now, the calculations are elusive, with each state still operating in a trial and error phase.

“How do you extend the social benefits like potential decrease in opioid use?” Whitney says stakeholders and voters wonder. “There’s a whole lot to the whole analysis of social costs.”

Alexis Keenan is a New York-based reporter for Yahoo Finance. She previously produced live news for CNN and MSNBC and is a former litigation attorney.

Read more:

These 5 states will have marijuana-related ballot initiatives on Tuesday

Why Philadelphia halted plans to unleash e-scooters across the city

Here’s how eBay alleges Amazon illegally lured its ‘high-value’ sellers

Winning the Mega Millions is sweeter in some states than others