Cruz balks at campaign-loan disclosure

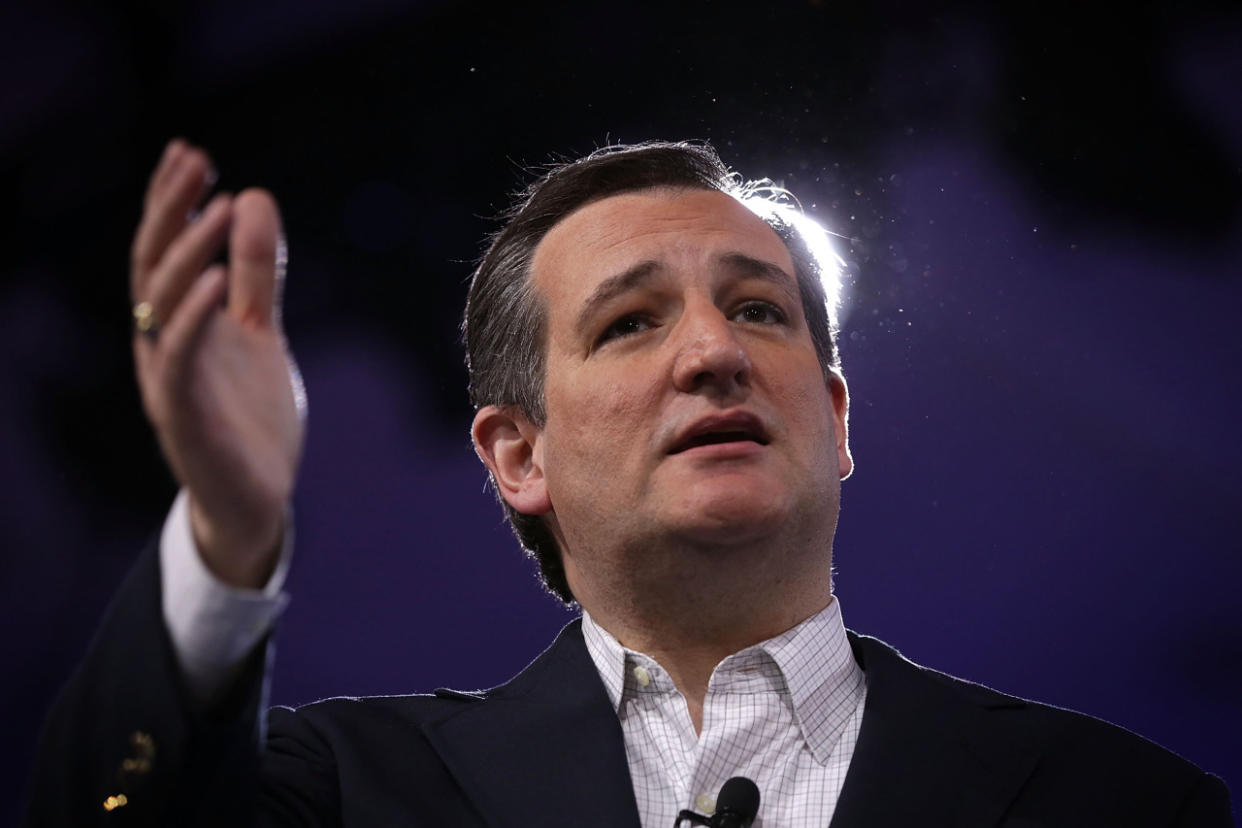

Republican presidential candidate Sen. Ted Cruz at the CPAC 2016 gathering in National Harbor, Md. (Photo: Alex Wong/Getty Images)

Ted Cruz has rebuffed a request by the Federal Election Commission to disclose more information about some $1 million in loans he received from two major Wall Street banks during his 2012 Senate campaign.

In a letter to the FEC this week, the treasurer of Cruz’s 2012 campaign turned down a request by agency auditors to reveal in writing “the complete terms” of two personal loans Cruz received from Goldman Sachs and Citibank — the proceeds of which, he has since acknowledged, he used to finance his upstart race for the Senate.

“They’re stalling on what they should have disclosed four years ago,” charged Craig McDonald, executive director of Texans for Public Justice, a liberal advocacy group that has filed one of two complaints with the FEC over the loan issue. “This is a critical point in the presidential campaign, and they don’t want any more new information about it coming out now.”

The Cruz campaign did not immediately respond to a request for comment. But in his March 8 letter to the FEC, Bradley Knippa, the treasurer of Cruz’ 2012 campaign, offered this explanation for declining the request from FEC auditors: It is already cooperating with another arm of the agency — its enforcement division — that is conducting a separate review of the loans in response to the complaints filed by Texans for Public Justice and another advocacy group. And those reviews are conducted under strict confidentiality rules that, Knippa argued, forbid making any more information public.

“You can expect our cooperation to bring this matter to a quick and amicable resolution,” Knippa wrote in his response to agency auditors. “Therefore, we intend to file our responses to this matter in accordance with the agency’s standard practices and procedures.”

Brett G. Kappel, a veteran campaign finance lawyer, said the Cruz campaign had a substantive legal argument in this case, but its practical effect, he argued, will be to delay any more public disclosure about a potentially awkward issue until after the election (enforcement division proceedings typically last a year or, in some cases, much longer). Moreover, Kappel noted, the confidentiality rules cited by the Cruz campaign are intended to make sure FEC officials don’t disclose information they learn in the course of a proceeding — and do not forbid the candidate from making anything public.

The loans from Goldman Sachs and Citibank erupted as a campaign issue in January after the New York Times reported that Cruz had failed to report them on his campaign disclosure forms at the time he received them. Donald Trump said they proved that the “guys at Goldman Sachs” – where Cruz’ wife, Heidi, had worked–have “total, total control over him.” (Trump has declined to release his own income-tax returns, claiming they are under audit by the IRS. Last month Cruz accused Trump of “hiding” information that “the voters have a right to know.”

Cruz has explained that his failure to the report the loans to the FEC was “a paperwork error” because they were separately disclosed on his personal financial disclosure forms with the secretary of the Senate, although in broad categories that did not indicate at the time he was using the proceeds to fund his campaign.

“Just about every lobbyist, just about all of the establishment opposed me in the Senate race in Texas, and my opponent in that race [Lt. Gov. David Dewhurst] was worth over $200 million,” Cruz said at the time. “He put a $25 million check up from his own pocket to fund that campaign.” So, Cruz said, he and his wife, Heidi, “took a loan against our assets to invest it in that campaign to defend ourselves against those attacks. And the entire New York Times attack is that I disclosed that loan on one filing with the United States Senate, that was a public filing. But it was not on a second filing with [the FEC] and yes, I made a paperwork error.”

Cruz had in fact reported the loans on his candidacy and Senate disclosure forms with the secretary of the Senate: They showed a margin loan from Goldman Sachs valued at $100,000 to $250,000, carrying 3 percent interest, as well as Citibank loans totaling between $500,000 to $1 million. But there was no indication at the time that he was then using that money to fund his campaign against Dewhurst.

The day after the New York Times story broke, the Cruz campaign’s Knippa wrote a letter to the FEC saying that the “underlying source” of personal loans that Cruz had made to his campaign had been “inadvertently” omitted from his FEC disclosure forms and they “should have been reported” to the agency. That underlying source, he said, was a Goldman Sachs “margin loan” in 2012 at a 3 percent floating interest rate, and a Citibank line of credit at “prime plus floating interest.”

While those terms would not, on their face, appear to be out of line, FEC auditors in its Reports Analysis Division wanted more. On Feb. 2, 2016, they wrote Knippa a follow-up letter noting that if Cruz had in fact received loans from lending institutions to fund his campaign, he needed to amend his disclosure reports to indicate the source of each loan and fill out a separate form providing “the complete terms of the loan between the candidate and the lending institution.” The form also requires that the candidate disclose the precise amount of the loan, not merely the broad categories that Cruz reported on his financial disclosure forms.

“An adequate response must be received at the Senate Public Records Office by the response date noted above,” wrote Bradley Matheson, the senior campaign finance and reviewing analyst, referencing a March 8 deadline. “Failure to adequately respond by the response date noted above could result in an audit or enforcement action.”

McDonald of the Texans for Public Justice said Cruz had an obvious motive for not fully reporting Goldman Sachs and Citibank loans in 2012 at a time he was running against Dewhurst as an anti-establishment crusader. “He was ranting against Wall Street and how he was a populist,” he said. “He was railing against the fat cats.”