First-Time Homebuyers Are Sharing The Things They Did "Aggressively Wrong," And I'm Taking Notes

Buying a home is not for the faint of heart. Even if you're fortunate enough to be able to afford a home of your own, the process of actually purchasing one is daunting at best. Add in the fact that the housing market is currently ~boiling hot~, and yeah, it's tough out there for a first-time homebuyer.

I bought my first home last year. Though it was absolutely worth it in the end, I was totally unprepared going into it. I did so many things so aggressively wrong, but luckily, I'll never make those same mistakes ever again. As a result, I was super curious to see what mistakes other first-time homebuyers made (and what lessons they learned from them).

Recently, I asked members of the BuzzFeed Community to share their "best piece of advice for anyone looking to purchase a home," and as you'll soon realize, their advice was 💯.

Here's my best piece of advice: Whether you're just starting your home-buying process or simply obsessed with scrolling through Zillow listings whenever you get a spare minute, it's never too early to start taking notes.

1."Do a walkthrough while it’s raining. It’s a horrible surprise to find out your new basement walls leak after your first rainstorm as a homeowner."

—Anonymous

2."If you do one thing, shop around for a realtor — do not settle for just anyone!"

"Some are very pushy and desperate to make sales, therefore, they push all their bad homes (or homes that have not sold in a year or more) first. There are also many that won't really listen to your needs as a prospective buyer. When meeting realtors, like everything else, go with your gut. If something is off, it's off. You need a realtor that will LISTEN and take into account what you need and want. Don't just pick the first one you see or talk to, and find your realtor before you even start searching for homes online. The right realtor can make all the difference, and yes, good ones exist!"

3."I wish I had been more informed about the 'worst-case' scenarios of dealing with a difficult seller. In my situation, the seller almost immediately regretted accepting our offer (after realizing it was below market value), and they did everything in their power to back out of the deal ahead of closing..."

"For example, they sent us notices to perform with incredibly short deadlines (such as waiver and contingency removals) every few days — all in an effort to back out of our deal. While this might not be typical, no one told me how to prepare for it or how to handle their tactic. It all worked out for me in the end, but it was a highly-stressful month and I spent hours nearly every day dealing with a barrage of hurdles and paperwork."

Warner Bros. / Via giphy.com

4."Don't not buy a house just because you can't afford your dream home."

"You don’t have to wait for a house that gives you 'the feeling' — it just has to be a house to get you where you want to be next. It doesn’t have to be your forever home!"

—Anonymous

Legacy Nashville / Via giphy.com

5."Get a home inspection no matter what, but you can also do the following things on your own when touring a home..."

"Run faucets and shower heads, and flush toilets to check the water pressure. Turn on all the lights. If there are carpets, ask what's under them. Ask about water issues, whether it's city water or well water. If you buy in Winter, ask for info on the landscaping or what's planted in the garden. And here's a major one: Scope out any problematic trees you might need to pay a hefty fee to have trimmed or removed."

America's Funniest Home Videos / Via giphy.com

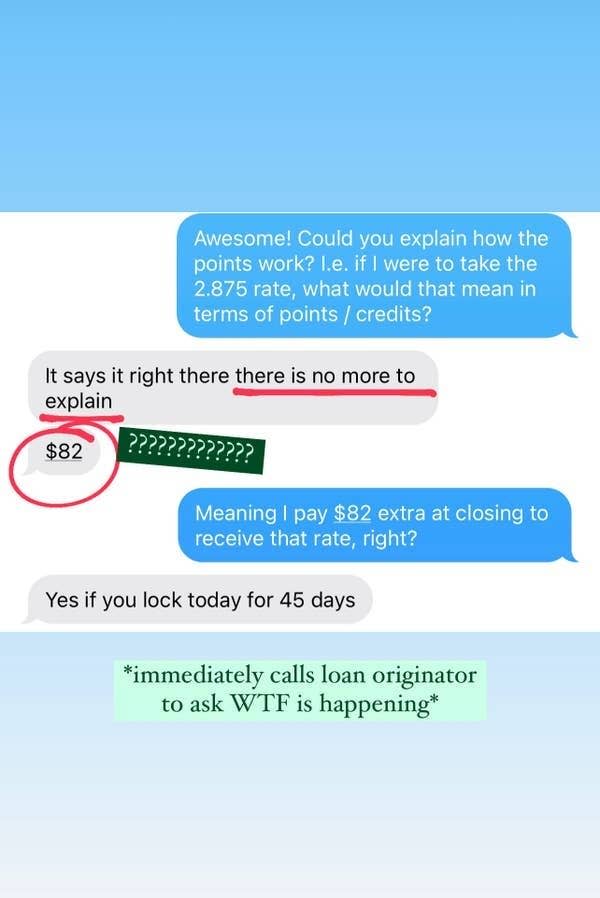

6."You need to do your research on home loans (and prepare for the application) well in advance."

"It's never too early to start making sure that you're the ideal loan candidate. The reason why my home-buying experience went so smoothly is because I had all my information together. The loan officer is going to ask about debts, outstanding loans, income...pretty much every detail about your financial history. Have your paperwork together, make sure that you have the information ready for them, and get it to them as soon as they ask for it."

—Anonymous

7."I wish I had quadruple-checked spelling on every piece of paper. Because my last name was spelled wrong one time, in the beginning of my loan process, it nearly cost me my entire deal at the closing table."

Sally Kohn / Via giphy.com

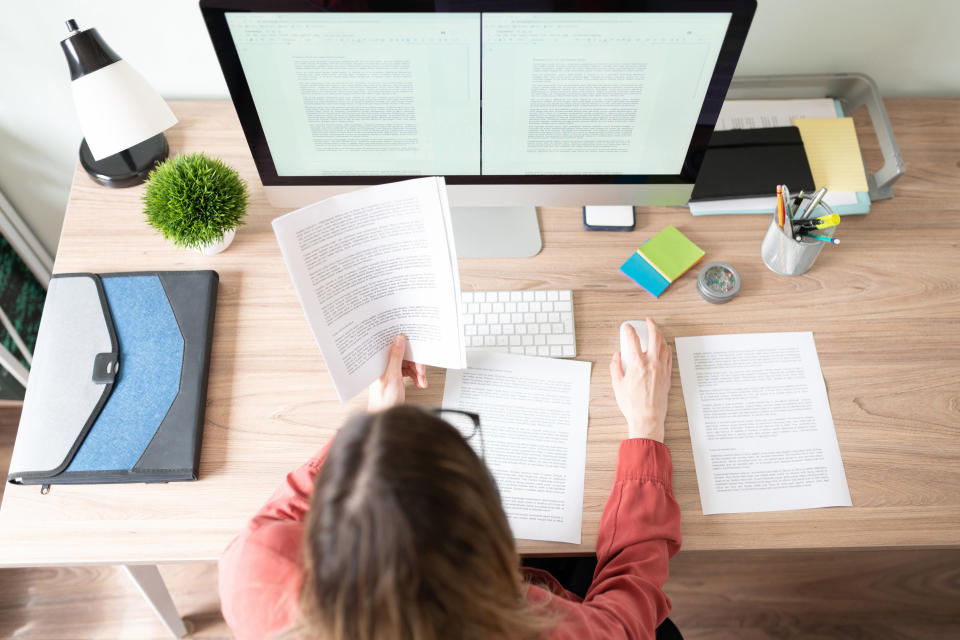

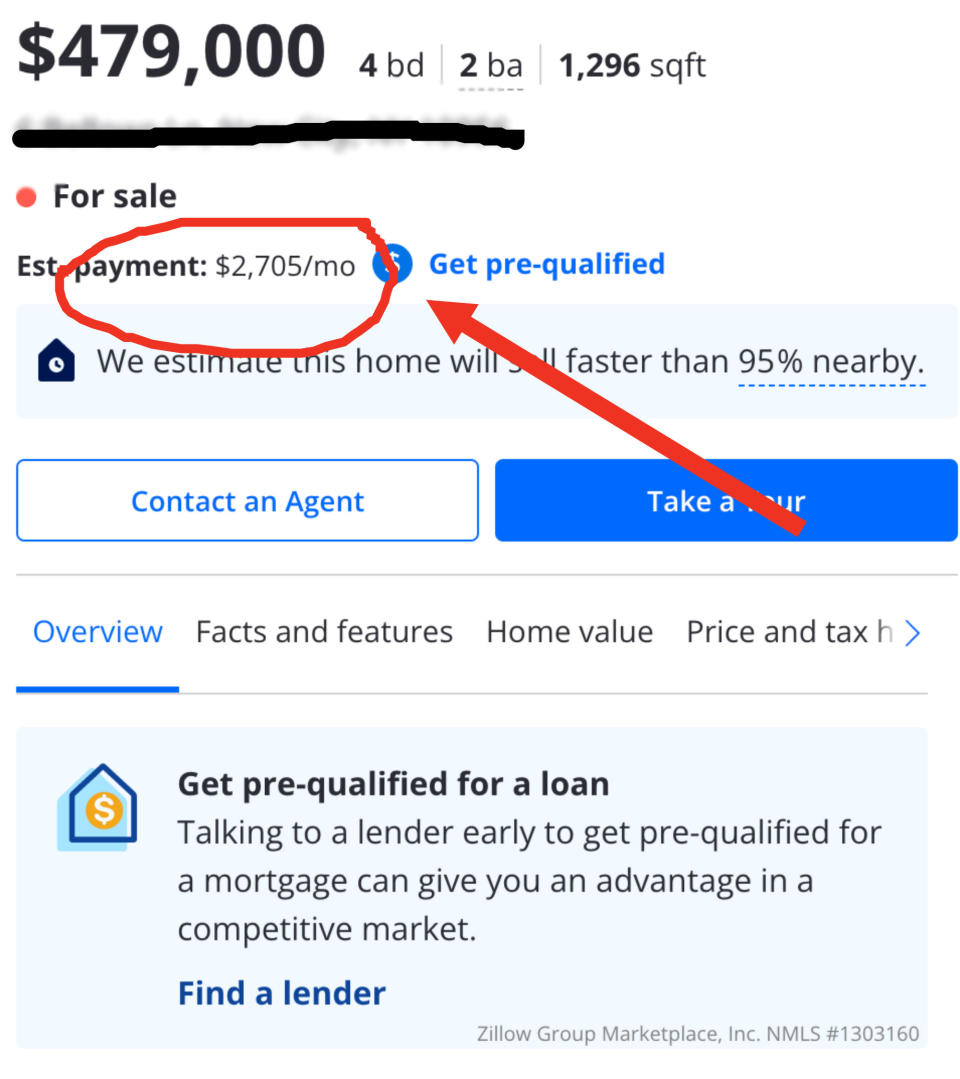

8."It's so important to understand how much house you can actually afford."

"The price of a home does NOT just include the physical home, no matter how enticing it can be to gush over that monthly cost on Zillow (especially when it's below what you're paying for rent). How much are property taxes? Do you have an HOA or POA? Are you able to cover a big expense like a roof replacement or HVAC replacement, should you need one? Be an informed consumer!"

—Anonymous

9."When choosing a realtor, make sure they are licensed — and, if possible, get realtor recommendations from friends who have recently purchased homes."

"It is very helpful to have a realtor who is knowledgeable about home construction and the area in which you’re buying. Remember that as a buyer, your realtor only makes money if you purchase a home! Keep that in mind when considering any guidance they provide. You might love working with them, but at the end of the day, it's all about the financial transaction."

10."Don't buy a recent flip. You want to be the second person to live in a flip — not the first."

"People flip houses to make money, so it's safe to say that most don't really care about the house at all, let alone the future owners. If you do buy a flip, set aside a large enough 'just in case' budget if things don't go as planned once you move in."

11."Everyone said that my mortgage would be the same (or less!) than what I'd pay in rent...but the truth is, as a homeowner, you'll pay for a lot more than you ever did as a renter. This cannot be over-emphasized to a first-time buyer."

"You'll pay for more than you could've ever imagined: Your utilities that need to be hooked up, property tax, mortgage insurance (if using), even homeowner's insurance. You'll have to buy appliances, pay to move, and buy so much 'new homeowner' stuff to make your home move-in ready. By the time the dust clears, you'll have spent way more than it costs to rent. That said, it's totally worth it...just crunch the numbers ahead of time!"

—Anonymous

NBC / Via giphy.com

12."Work with a reputable mortgage broker. It does not cost you anything (at least in my state) and makes the loan application process much less daunting."

"They will walk you through all the paperwork you need and handle negotiations with lenders. Also, our mortgage broker had a great reputation, which made us even more credible buyers in the eyes of sellers."

13."Always, always, always set up the inspection for yourself. Use someone you find on your own — not the lender's suggestion, and not the realtor's suggestion."

"I bought a new build and found 15+ problems with my inspection. If a new build can have that many problems, I don't even want to imagine what a normal house could have."

American Family Insurance / Via giphy.com

14."Don't just get pre-qualified for a mortgage — get pre-approved."

"Pre-approval is basically the same thing as having a cashier's check in hand for a rental — you will be one step further along in the process than you would be if using a pre-qualification only. Don't be fooled, though — the amount you're pre-approved for will often be more than you can actually afford, so in terms of your budget, still aim for a bit lower than the maximum."

Mortgage Monk / Via giphy.com

15."If you don't have enough cash for your theoretical downpayment, look for financial assistance. There are lots of federal programs to help out first-time homebuyers financially, and make sure you see what's available within the state your buying in, too."

—Anonymous

16."Before you close, do more self-inspecting than even the inspector would do."

"Don't be afraid to pull up a tiny corner of carpet in each room to find out what's underneath it. Crawl on the floors — I'm not kidding — to scope out bugs, or things along the wall that you wouldn't see while standing. I wish I had looked at the tiny things rather than each room as a whole. It would have really helped in the long run."

17."Be prepared to submit documentation to support every single detail of your life for the loan underwriting process. Timelines matter, and stalling the process on your end can forfeit your approval."

Disney

—Anonymous

18."Make a list of your must-haves vs. wants."

"Limit must-haves to five or less, and be prepared to give up at least one or two of them. Your list of wants can be a mile long, but don't expect to get any of them. This market is hard to navigate, and it's important to know what you simply can't live with or without before you put down an offer."

—Anonymous

19."If you're looking at photos of a home online and the photos seem really sharp or heavily-edited, it can sometimes be a red flag."

"The seller may very well hope that by over-editing the photos, you won't notice flaws."

20."Definitely don’t aim for a home that costs the maximum amount you’re pre-approved for! You will have tons of expenses in addition to your monthly mortgage payments."

"Be honest about how much space you really need, and keep in mind that it will also cost you more money to furnish, maintain, and heat/cool a larger space."

Columbia Records / Via giphy.com

21."Do your research on the neighborhood and street. Try to go to the home you plan on buying at different times during the day, and even at night if you can."

"You can do as many renovations as you want on the house itself, but if you hate the neighborhood, you still won’t be happy. I wish we would’ve done that before we bought our current home — now we can’t wait to get out."

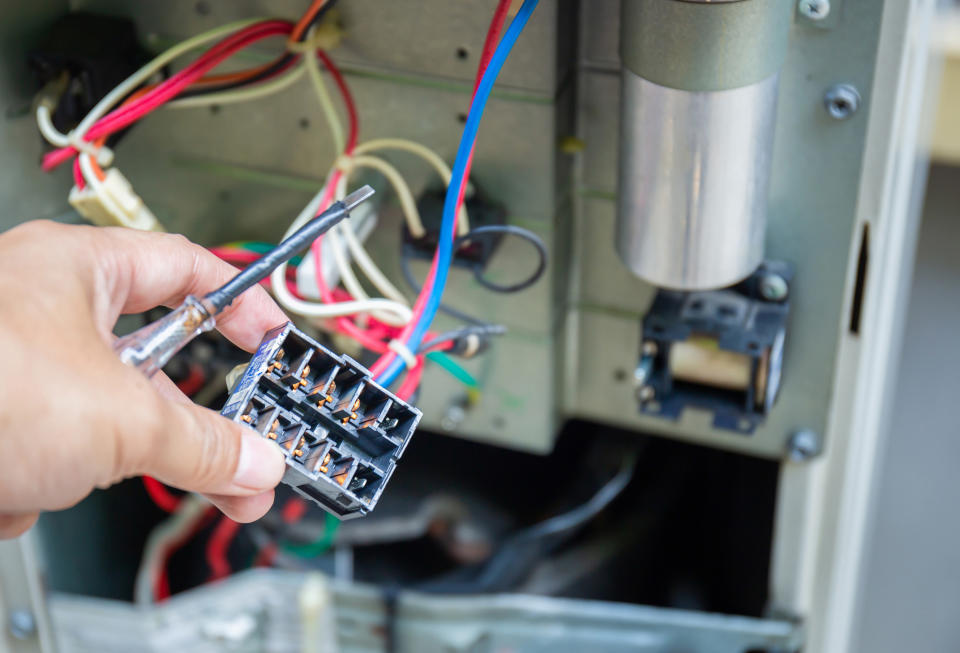

22."Don't blindly trust the home inspection. If your budget allows, hire people that are specifically-trained to inspect various elements of your home."

"Have someone come to specifically check out the HVAC system, electrical work, and plumbing — especially sewer lines or septic systems. Our inspection said things were 'old, but OK.' Two months and $20K later, we beg to differ."

23."Don't expect that the sellers care about you or the home after you buy it. We are still finding things that were not disclosed or taken care of before we moved in, but we can't do much about them."

"Make sure to get a sewer inspection! Also, consider asking that the house be professionally cleaned in the contract. We learned the hard way that some people have VERY different definitions of 'clean.'"

—Anonymous

Netflix / Via giphy.com

24."Budget for more 'must-buy' items than you think you'll need — there were so many purchases I made in my first few months of home ownership, and as someone who rented previously, they weren't things that ever crossed my mind."

"I needed to buy a lawnmower and tons of other yard items, since I didn't have anyone close by who I felt comfortable borrowing from. I didn't factor it in ahead of time, and was already feeling way poor due to the hit my accounts took when I closed. Money-wise, we had a really tight first couple of months."

—Anonymous

Starz / Via giphy.com

25."Even if your home is 'move-in ready,' assume you'll have to do some renovations. Then, factor those estimates into your overall budget."

"Even if you’re buying a brand new house, assume you will still need to renovate closets, bathrooms, kitchens, and landscaping. New construction does NOT mean better — it means builder-grade everything. All four of our bathrooms have zero storage (and the cheapest fixtures). Our deck wasn’t even built with treated wood, and there is hardly any cabinet space in our kitchen."

26."I wish I'd known to look at how old the furnace and water heater were. I ended up replacing the furnace in the first couple of years — luckily I could afford to, but I definitely hadn’t factored that expense into the value I offered for the home."

—Anonymous

27."There are so many little things you can check during your first tour at a prospective home — and they're all things that home inspectors might not even bother to check later on."

"Put your hand at the bottom of a bunch of windows to feel how drafty they are, and do the same with the doors. Look out for heavy perfumes and room sprays, since they are usually covering up smells: cigarettes, pets, fire, or mold. Watch out the front door for a while to get a sense of vehicle and foot traffic."

28."There is no such thing as a perfect house, so get real with yourself about the total dealbreakers and the things you could easily fix or improve."

"Be willing to look past things like paint colors and the current homeowner’s furniture! I’ve seen friends turn down houses that would have been great for them because 'it seemed small' (with the current homeowner’s giant sectional crammed in there) or they 'really wanted a deck' (which they didn’t even end up using on the house they did buy).

If you've ever purchased a home and want to share your best first-time homebuyer advice, let us know in the comments below! 👇

Note: Submissions have been edited for length and/or clarity.