Charge Enterprises to Compete in 2 Potential $100+ Billion-Dollar Markets

Photo by Chuttersnap on Unsplash

The world is transitioning from fossil fuels into an electric future.

According to the Paris agreement on climate change, several countries are set to phase out the production of new combustion-engine vehicles in the next decade. According to Deloitte, electric vehicles (EVs) will account for 10% of all cars sold by 2024.

Andrew Fox, CEO and founder of Charge Enterprises, Inc. (OTCMKTS: CRGE), spoke with Benzinga at its recent Global Small Cap Conference about the company’s efforts to help global electrification.

Doing the Unglamourous Work

Charge Enterprises is a portfolio of businesses with the vision of connecting people with communications, infrastructure and charging.

The company doesn’t manufacture EV charging stations — it installs, maintains and services them.

“We do the unglamorous work in terms of location selection, engineering, installation, testing and maintenance to equipment in the electric vehicle charging industries,” said Fox. “The way we see it, that's a bit of a long pole in the tent for both the manufacturers of EV charging stations and for the automotive industry. We're looking to find a way to remove that friction and help accelerate the transitions from fossil fuels to electric vehicles.”

With its EV charging stations, Charge Enterprises has a place in the telecom network infrastructure market. The company provides turnkey engineering, furnishing and installation (EF&I) for telecommunications solutions with engineering, installation and project management services to empower its customers.

The company is also working to create a network of power bank rental stations. Charge’s power bank rental stations will charge electronic devices on the go and keep consumers charged and venues happy with zero additional cost.

Charge is well-positioned to outperform as the EV charging station market is projected to be over $100 billion by 2027 with a 23.24% compound annual growth rate (CAGR) while the telecom network infrastructure market is projected to be over $100 billion by 2026 with 4% CAGR.

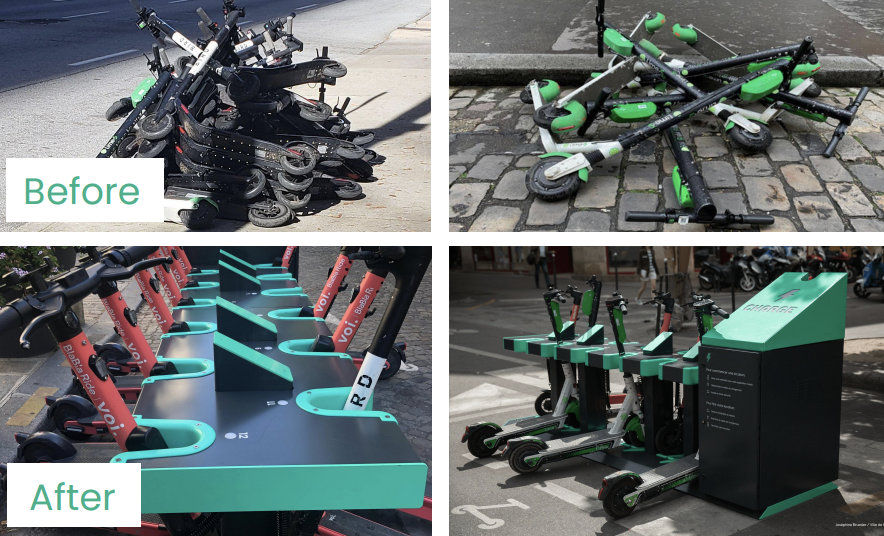

Clearing the Clutter

Image: Charge Battery-Powered Charging Stations

In another case of doing a job others don’t, Charge offers its services in the micro-mobility infrastructure. The company solves a pertinent problem involving scooter clutter safety. As a result of proper infrastructure, the company aims to avoid injuries, complaints and lawsuits from non-riders.

The company has operators in over 150 cities and has deployed over 1.2 million scooters. It has over 50% of global business in the EU, 40% in the U.S. and 10% in Asia and fleet sizes of 15,000 in Los Angeles and Paris.

Company Highlights

Charge Enterprises earned annual revenues of over $500 million with a sales presence in 19 countries.

On May 25, 2021, the company announced it acquired advanced network services (ANS), a leading turnkey provider of direct current (DC) power installation and telecommunications services.

In Q1 2021, Charge added Benjamin Carson Jr., co-founder and partner at FVLCRUM Funds and chairman of Interprise Partners. It also added two-time NBA all-star and entrepreneur Baron Davis to its board of directors.

View the entire Charge Enterprises presentation here. For more information on the company, visit https://www.charge.enterprises/.

See more from Benzinga

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.